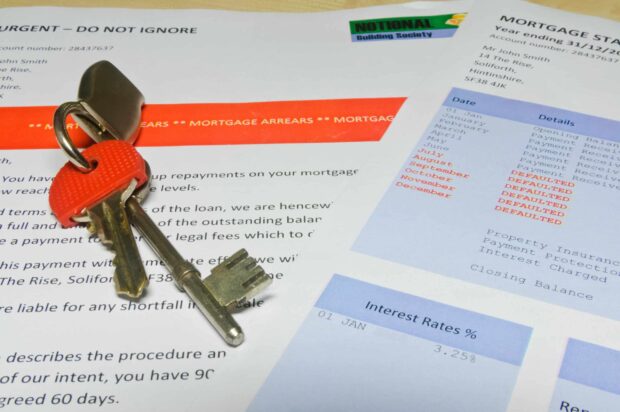

Dealing with Debt: 5 Essential Tips

Dealing with debt: 5 things you should know 1) There are sources like Money helper for free debt advice and services. You can find out more by contacting Money Helper on www.moneyhelper.org.uk or 0300 500 5000 (8-8 Monday to Friday, 9-1 on Saturday). 2) You should have been advised on all the options for dealing with…