It’s no secret that managing your finances can be difficult, especially if you don’t have all the support you need. As a single parent, all financial responsibilities can fall to you, which can take a toll not only on your finances but also on your mental health. Both debt and mental health are topics that can be difficult to talk about, particularly because of the stigma that is so often attached to them.

At MoneyPlus, we wanted to start a conversation on the specific challenges single parents are facing in today’s society. To explore this, we conducted a survey of 1,000 single mums and dads, giving them an opportunity to share their stories in the hope that single parents will recognise they’re not alone in this.

This article will take a look at the results, first focusing on the biggest financial concerns of single parents. We will then have a look at how this is connected to their mental health. With World Mental Health Day fast approaching, our campaign aims to encourage people to prioritise their mental wellbeing and not be ashamed to ask for the help they need.

What are the financial concerns of single parents?

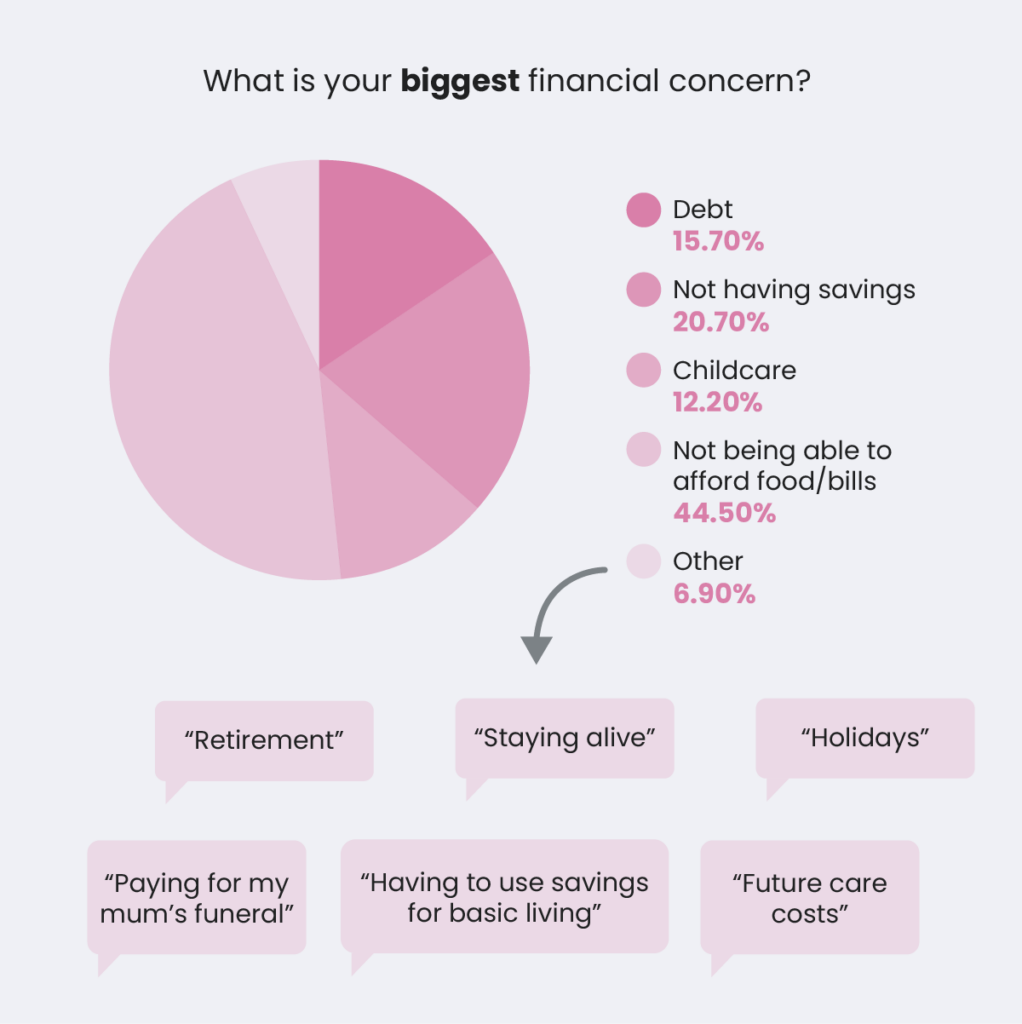

Raising a child is a wonderful thing but it also has many costs, from food to clothes to childcare. As part of our survey, we asked single parents a number of questions about their financial situation and the challenges they encounter. There were three areas that caused single parents the most concern – food, bills and childcare.

Food and bills

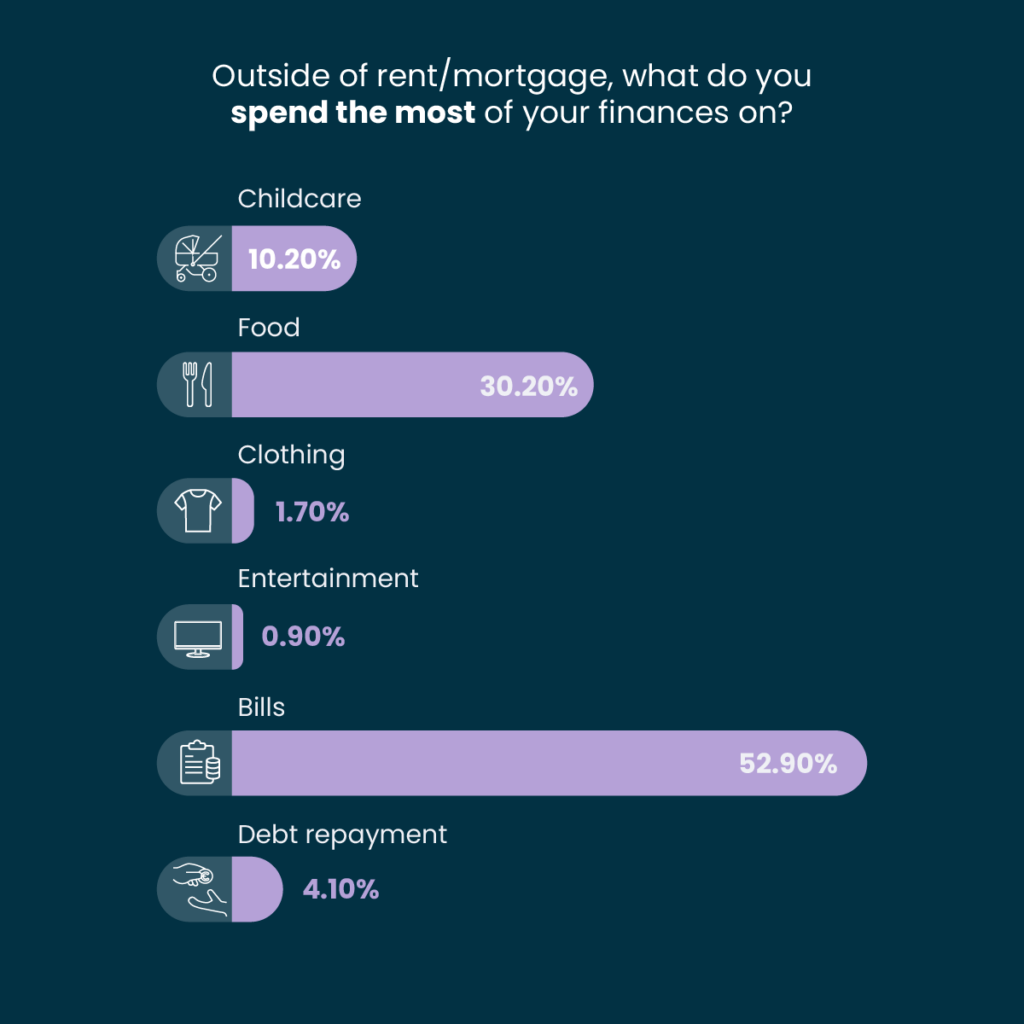

According to our survey, the two things single parents spend most of their money on outside of rent or mortgage is food and bills. Over half of those asked (52.9%) said most of their income went on bills, while 30.2% chose food. There are many different types of household bills, including gas and electricity bills, water bills, TV licence fees and council tax.

With so many different ones, it can be hard to keep track of them all but there are ways you can manage these bills, such as keeping a written record or seeking out advice on debt solutions.

Due to how many bills there are and the rising costs of gas and electricity, it’s perhaps unsurprising that this is where single parents are spending most of their income.

However, the fact that nearly a third spend more on food than bills shows how much inflation of food prices has affected single parent households. The Office for National Statistics (ONS) reported in the 10 years prior to January 2022, inflation for food and non-alcoholic drinks was typically 9% but from January 2022 to January 2024, this rise was around 25%.

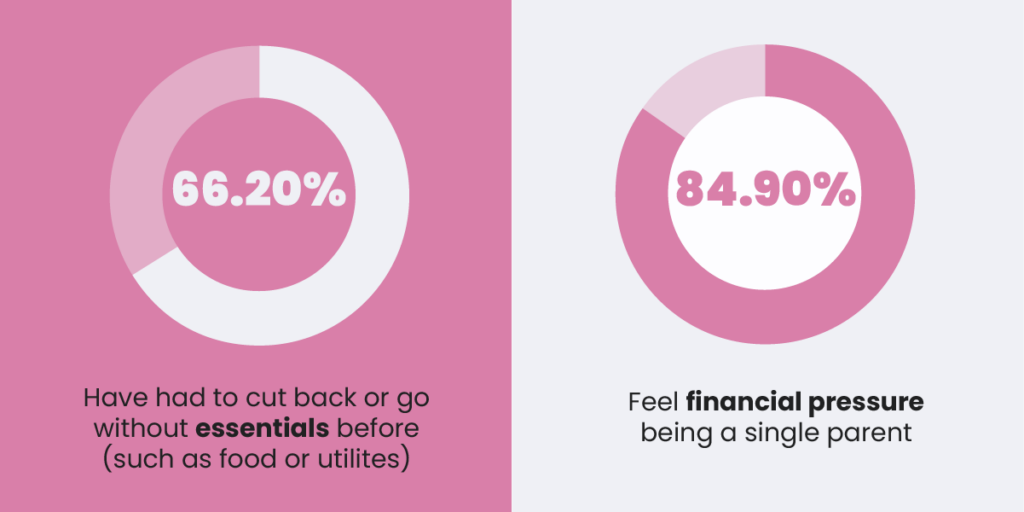

Although the inflation rate has decreased since, many families are still struggling to afford the essentials. This was reflected in our survey, where 44.5% of respondents answered that they were most worried about not being able to afford food or bills. Sadly, this concern has become a reality for many. Shockingly, 66.2% of those surveyed said that they had had to cut back or go without the essentials, such as food and utilities.

This high percentage shows how financially difficult it can be to raise a family as a single parent in the current economic climate.

Childcare

As both single dads and single mums took part in our survey, we were interested to see if there was any disparity between their answers. The biggest difference was their employment status. The majority of men at 69.43% worked full-time, in comparison to 45.39% of women. While roughly the same amount of men and women selected self-employed, double the percentage of women were unemployed or part-time compared to men.

There are a number of reasons for this but answers to some of our other questions indicate it could be to do with childcare. For example, 16.38% of men said their biggest financial concern was childcare, in comparison to just 8.67% of women. Similarly, 13.54% of single dads surveyed said that outside of rent/mortgage, they spent most of their money on childcare, whereas the figure for single mums was 7.38%.

Therefore, men are more likely to pay for childcare and work full-time, whereas women may work part-time and look after their children at home instead. Although this saves money on childcare, not working full-time has an impact on finances. According to our survey, 90.77% of single mums worry about their financial future compared to 78.6% of men.

Finding the right childcare solution is difficult for any parent. However, as a two-parent household, it is an issue you can tackle together and can often find a childcare schedule that fits around both parents’ work schedules. For a single parent, it is harder to find the right balance between having a steady income, paying for childcare and spending time with your children.

What is the impact of debt on mental health?

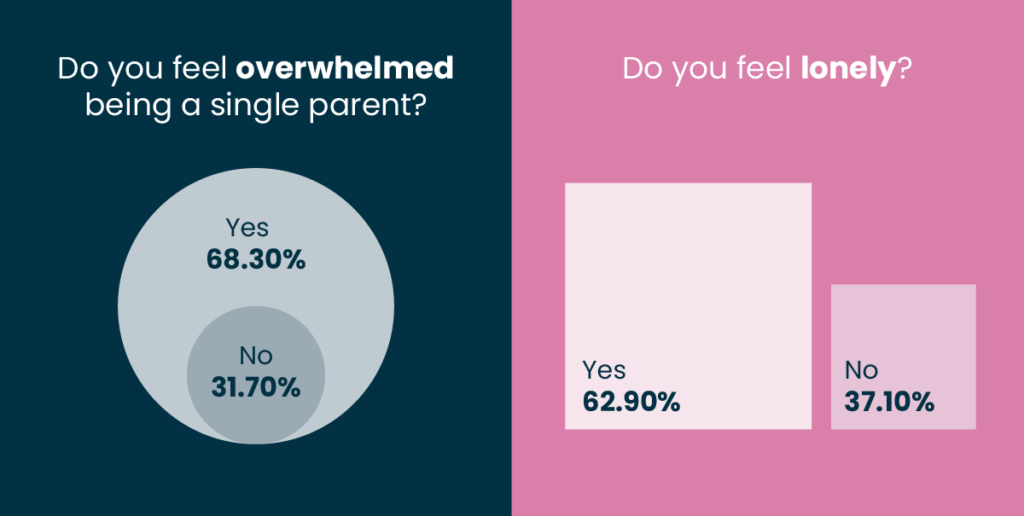

Debt can be a heavy burden for anyone, but for single parents, it often comes with an additional layer of stress. As discussed above, juggling bills, childcare, and everyday expenses on a single income can be very challenging. Many single parents face the pressure of being the sole provider, and the fear of falling behind or not being able to provide for their children can cause feelings of worry and helplessness.

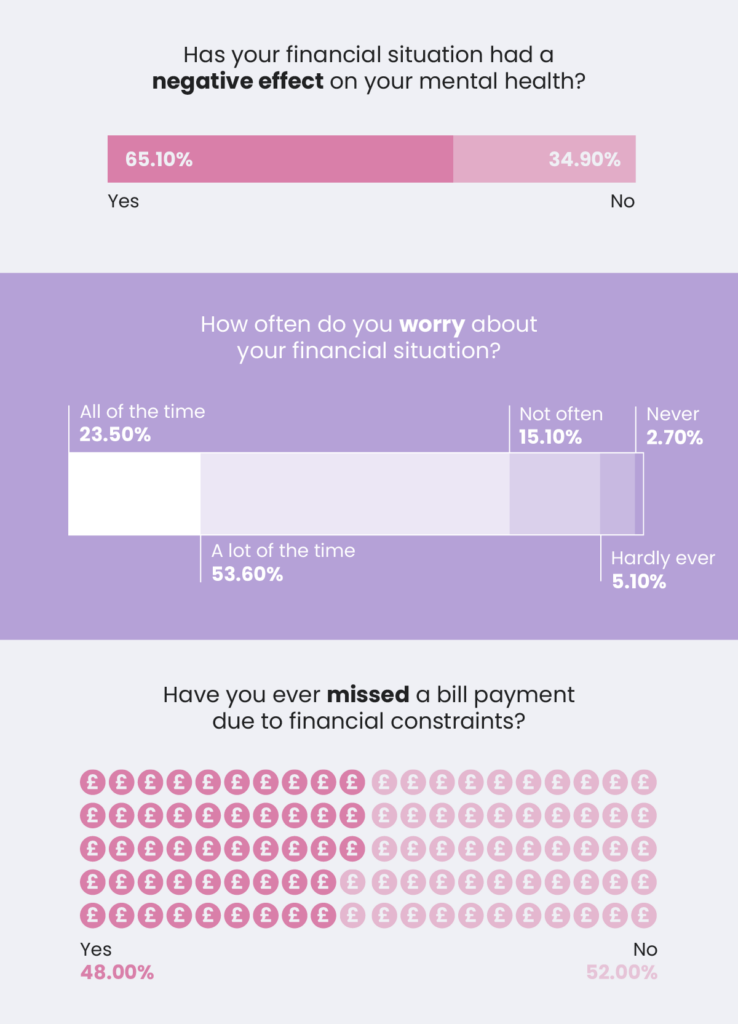

This experience of single parenthood is reflected in our survey, where 68.3% said they felt overwhelmed. Without another person to make decisions with and offer support financially, being a single parent can feel isolating and take a real toll on your mental health. Sadly 65.1% of those surveyed echoed this, saying that their financial situation had negatively impacted their mental health.

When you are constantly consumed with debt, it leaves little room for mental relaxation, and this persistent worry can severely impact your emotional health, potentially causing financial anxiety. In our survey, 53.6% of respondents admitted they worry about their financial situation much of the time, and a further 23.5% said they are worried all of the time.

Whatever your financial situation is, you may feel like you’re alone in this as a single parent. In fact, 62.9% of our respondents said they felt lonely. However, as our survey shows, you are definitely not alone and many single parents face the same challenges.

With all the responsibility being a single parent brings, it can be hard to prioritise your own needs but there is no shame in asking for help. If you are struggling with your mental health, make sure to reach out to your local GP or get in touch with organisations such as Gingerbread (an advice service specifically for single parents).

If you are struggling with debt, you can visit MoneyHelper to get free advice.

Alternatively, don’t hesitate to get in touch with us. We can offer advice and guidance on the different debt solutions available, including Debt Management Plans (DMPs) and Individual Voluntary Agreements (IVAs). This may be able to help reduce some of the financial pressure and stress on your everyday life.

Are you a single parent who has concerns over their finances or mental health? To join the discussion and share your story, use the hashtag #SoloParentStruggles on social media.