Juliet became part of the MoneyPlus team as a Content Writer in February 2024, where she now oversees the blog and co-writes the newsletter. Her work focuses on making financial topics understandable for all.

With five years of experience in content, Juliet began her career as a Journalist at MoneySavingExpert, where she developed a deep understanding of consumer finance.

Over the past few years, the UK has seen a big change in how we view and manage personal debt. What used to be avoided is now a normal part of everyday life, with various types of credit being used more frequently. Buy Now, Pay Later (BNPL) products are becoming an increasingly popular payment method…

After rent or mortgage, your car is probably the biggest consumer of your cash. It doesn’t matter whether it’s a rackety run-around or a sleek saloon, keeping it on the road is a major expense with rising fuel prices, car insurance, tax, maintenance, servicing and MOT. Here are five quick wins to help put the…

The time has come for you to move out of your rented property. You might be tempted to gather up your gear, say your goodbyes and go. If you leave without a backwards glance, chances are you’re going to walk away from your deposit. Here are some quick tips to make sure you get your…

Energy efficiency isn’t just about saving the planet – which is a very hot topic. It’s also about saving money, which is an incredibly cool thing to do. Creating a more energy efficient home is not that difficult, and the good news is, you don’t have to do it all at once. You can just…

For sale: Your dream car. Comes complete with full service history and insurance costs that will take a big chunk out of your driving budget. Insuring your car is an absolute necessity. But, if you’re not careful, it can be an expensive essential for getting behind the wheel of your new motor. Check out these…

When you start looking round for a new home, there are plenty of important questions that need answering. Such as: ‘Is there enough room for a pool table / 62 pairs of shoes?’; ‘Do the neighbours like rap music?’; Or ‘How far away is the nearest pub?’ But the two you need to address first…

When you’re dealing with significant debt, things can quickly become overwhelming. Day-to-day tasks can become more stressful and life can be made especially daunting if you’re also being faced with the prospect of bailiffs knocking on your door. Employed by creditors to recover unpaid debts, the thought of these collection agents turning up at your…

Debt collection is the process used by creditors to get money back that hasn’t been paid by individuals or businesses who owe it. It’s important for both the people trying to collect the debt and those who owe the money to understand each step of this process. This helps creditors recover their money and makes…

Can an IVA Take My Inheritance? Coming into an inheritance can be a significant financial event in your life. We take a look at the intricacies of IVAs when it comes to dealing with windfalls such as inheritance, and what you might need to consider if you’re thinking of entering into one of these agreements.…

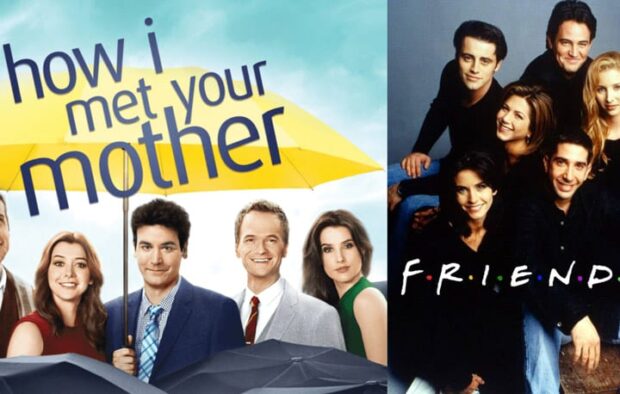

Debt can affect anyone, regardless of income, profession, or lifestyle, which is why it’s important to talk about money troubles and the impact they can have on day-to-day life. To help open up the conversation about debt, we look to some of our favourite popular TV shows and film characters who have struggled with financial…

In a time when the cost of living seems to be increasing continuously, overspending can become all too easy. From monthly Direct Debits on a host of subscription services to overreaching when it comes to family birthdays or special occasions like Christmas, overspending can put strain on relationships, negatively impact personal well-being, and even affect…

Can You Inherit Debt from Your Parents? Dealing with the death of a parent is tough, especially when complicated finances are involved. Here, MoneyPlus explores whether parental debt can be inherited. When a parent passes away, it can be a really difficult time, both emotionally and financially. Alongside the natural feelings of grief and sadness…