Monthly Savers: tips & tricks to boost that savings pot!

2024

February

This month we’re looking at how to stick to your budget when there’s an important date or holiday coming up.

This month, it’s Valentine’s Day! You can still share the love without breaking the bank – find some inspiration below…

Got a partner or friend who’s love language is receiving gifts? See our best gift ideas for under a fiver.

Prefer quality time? Check out our cheap date ideas, or better yet, 10 ways to have fun for free!

Foodie fan? Dine in with a romantic, candle-lit meal thanks to our hot tips to cut the cost of cooking.

Want an experience to make memories rather than buying something just for the sake of it? Enjoy a cheap city break or budget beach holiday!

January

To kick off the new year, we’re looking at ways to save smarter. If we can make saving as easy as possible, make it something we don’t even have to think about every month, then we’re more likely to stay on track with our savings goals.

Enter January’s tip: automate your savings.

Set up an automatic transfer every payday, so that each month a set amount goes into your savings account without you even having to think about it.

Setting this up to coincide with payday also means you won’t be tempted to spend the funds throughout the month, as it’s already safely tucked away!

2023

October

This month’s saving tip is all about taking advantage of the Autumn weather to cosy up at home.

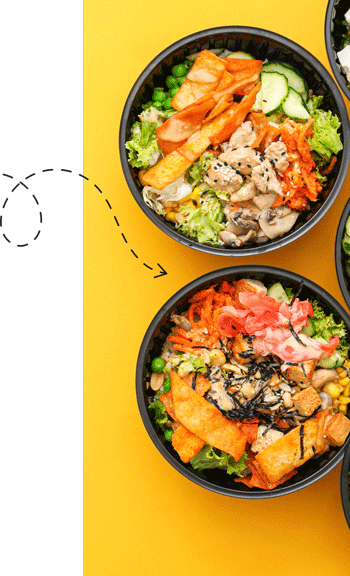

Save money this month by preparing meals at home. Autumn is the perfect time to transition into Winter warming meals that are ideal for batch cooking, for example, soups, stews, and casseroles.

Preparing meals at home can help you make big savings, as you’ll avoid splashing out at restaurants and on those lunchtime supermarket meal deals! Batch cooking can also save on energy costs, as you’re cooking multiple meals at once.

November

You may have heard of “Sober October” or “Veganuary”, but have you heard of “No-Spend November”?

No-Spend November is a money-saving challenge that, well, challenges you not to spend!

The idea is that you only spend money on essentials throughout the month of November, helping you to make some extra savings in time for Christmas.

Don’t be tempted by Black Friday deals, and only make the purchase if it’s something you really need!

Is it really a deal if you buy a new washing machine just because it had 40% off, if there’s nothing wrong with your current machine?

December

With Christmas just around the corner, this month’s saving tip looks at how to reinvent the concept of advent to save a little extra cash!

(As we’re already a couple of days into advent, this one may need to be back-dated a little!)

There’s two options for a savings advent – why not pick one, or try both together?!

Advent Savings 1

Save 10p for each day of advent.

For example, on the 1st December, save 10p, on the 2nd, save 20p etc. Once you hit the 10th, you’ll be saving £1, £1.10 for the 11th; the 20th December will see you save £2, and so on.

Run to the 24th December, and you’ll have totalled up a saving of £30 – include Christmas Day, and you’ll have saved £32.50. It might not seem like a lot, but every little helps!

Advent Savings 2

Do one thing to save money each day of advent. Although this could include putting some money into a savings account, it can also be small and simple changes that you can make to save a little each day.

Examples could include walking to the shops to save on transport costs, having a duvet day to cut heating costs, inviting friends round for a film night to save on cinema spends, or batch cooking instead of going out for a meal.