-

Can’t decide what to do about debt? Here’s how to start

When you’re overwhelmed by debt, it’s easy to feel frozen. You might have looked into debt solutions but found there were too many debt options to make sense of. Or perhaps you’ve been so stuck with money worries that you haven’t been able to face the decision at all. If that sounds familiar, you’re not

-

Dealing with debt collectors: your rights, options and when to get help

If you’ve been contacted by a debt collector, it’s natural to feel uneasy. Whether they’ve called, sent a letter, or even visited your home, it’s important to know that you have rights and options when dealing with them. This guide explains how to stop debt collectors from acting outside the rules, how to respond confidently,

-

How to stop debt collector contact: know your rights

Being contacted by a debt collector can be overwhelming, but it’s important to know that you have rights. Whether you’re receiving constant letters, phone calls or home visits, there are rules about how and when a debt collector can get in touch with you. This guide explains your legal rights, what debt collectors can and

-

Which debt solution is right for me?

Finding yourself in debt can feel overwhelming – especially when there are so many options to choose from. If you’re wondering which debt solution is right for you, this tool-style guide is here to help. We’ve broken down some of the most common debt situations and matched them to possible solutions to consider. Everyone’s circumstances

-

Ashamed to ask for money advice? You’re not the only one

If you’re feeling ashamed to ask for money advice, you’re not alone. Many people across the UK quietly struggle with debt or financial pressure – often for months or even years – because they’re too embarrassed to talk about it. If that sounds familiar, take a moment to pause. The fact you’re here, reading this,

-

What to do if you can’t talk to your partner about money

Let’s be honest – talking to your partner about money isn’t always easy. It’s one of those topics that can bring up all sorts of feelings: embarrassment, worry, even guilt. And yet, it’s also one of the most important conversations you can have with your partner. If you’ve found yourself avoiding money chats, or just

-

What to do when expenses are more than income?

When your monthly outgoings are bigger than the money coming in, it can feel like you’re stuck in a hole you can’t climb out of. Rising living costs mean more households are facing this problem, and it’s not always easy to know what to do first. In this guide, we’ll help you spot the warning

-

How to find out what debt you owe

If you’re worried about money but aren’t sure exactly how much you owe, you’re not alone. Many people lose track of their debts over time. This can happen if you’ve had multiple loans or credit cards, moved house, or simply avoided dealing with letters from lenders. But the fact is, knowing the full picture is

-

What is payday anxiety?

Payday should be a relief – the day your wages arrive after weeks of hard work. For many people, though, it is not always a happy occasion at all. Instead of feeling secure, they feel tense, unsettled, or even panicked. This feeling is called payday anxiety. It is becoming more common as the cost of

-

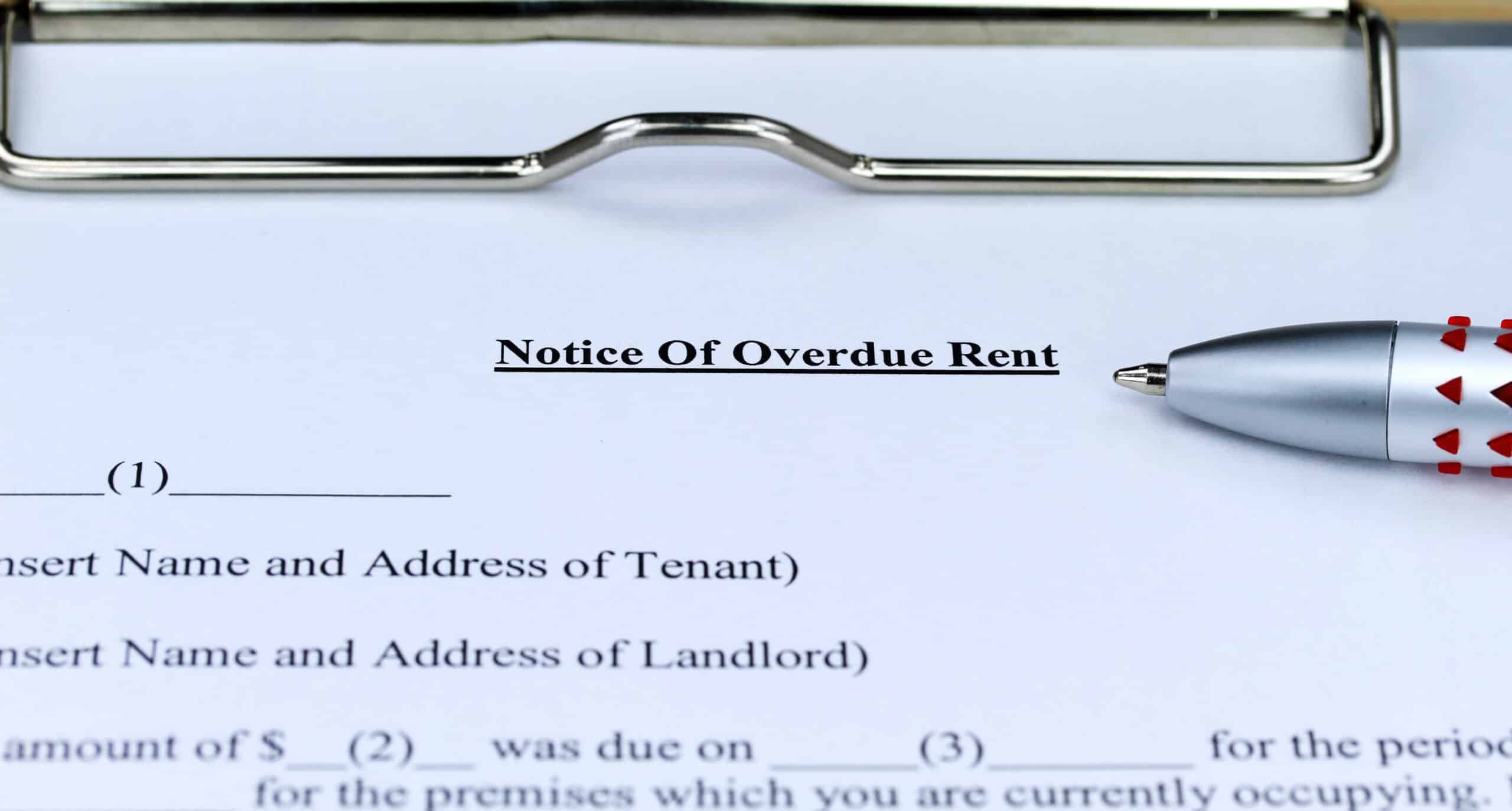

Rent arrears: what happens if you can’t pay your rent?

Struggling to pay your rent can feel scary, especially when everything else is getting more expensive too. If you’ve missed a payment or are worried you might soon, you’re not alone. More and more renters are in the same situation and need help to understand what happens next. In this guide, we explain what rent

-

What is a debt cycle?

Debt can build up slowly. At first, it might be a credit card here or a loan there. But over time, it can grow into something much harder to manage. This is what’s known as a debt cycle – a pattern where your borrowing keeps growing, and it feels like there’s no way out. Understanding

-

What can bailiffs take?

If you’ve missed payments and fallen behind on debts, you might be worried about bailiffs turning up at your door. It’s a scary thought – but knowing your rights can help you feel more in control. One of the most common questions people ask is: what can bailiffs actually take from my home? The answer

close

MoneyPlus Advice Articles

You are here:

- Home

- MoneyPlus Advice Articles