-

Priority vs non-priority debts: what you need to know

When money is tight, it’s natural to feel unsure about which bills to pay first. Not all debts have the same consequences if you miss payments, so knowing the difference between priority vs non-priority debt is essential. In this guide, we’ll explain the key terms, outline the types of debt UK households commonly face, and

-

IVA vs DMP: Which is right for you?

If you’re dealing with unmanageable debt, two of the most common solutions you might come across are an Individual Voluntary Arrangement (IVA) and a Debt Management Plan (DMP). Both can help you regain control of your finances, but they work in very different ways. In this guide, we’ll explain the difference between an IVA and

-

Choosing the right debt help: a step-by-step guide

If you’re struggling with debt, the number of options available can feel overwhelming. From formal agreements like Individual Voluntary Arrangements (IVAs) to flexible repayment plans, it’s not always clear which route will suit your situation best. This step-by-step guide will help you start narrowing down your options, so picking a debt solution becomes less daunting.

-

What can a debt collection agency take from me?

If you’ve received a visit or letter from a debt collection agency, you might be wondering what they can take from you. Understanding your rights is the first step in protecting your belongings and taking control of the situation. In the UK, the powers of debt collectors are limited, and knowing the difference between a

-

Bailiffs and council tax in the UK: what you need to know

Finding an official-looking letter on your doormat can be worrying, especially if it’s from bailiffs or council tax enforcement officers. Ignoring it won’t make the problem go away. In fact, doing nothing could make the situation worse. This guide explains what triggers bailiff action, your rights if they contact you, and how to stop the

-

Facing debt letters: how to move forward

If you’ve ever found yourself staring at a pile of unopened envelopes or ignoring notifications from your bank, you’re not alone. Many people feel scared to open debt letters, avoid looking at bank statements, or can’t bring themselves to check bills. That fear can build over time, and the longer it goes on, the harder

-

Preventing bailiff action: your step-by-step guide

If you’ve been told bailiffs may visit your home, acting quickly is essential. In many cases, you can take steps to stop bailiff enforcement before it starts. The sooner you act, the more options you’ll have to protect your belongings and prevent extra fees. This guide explains how to stop bailiffs coming, what your legal

-

What to do when you can’t afford food

If you’ve reached a point where paying for groceries feels impossible, you are far from alone. Rising living costs have pushed many households into difficult situations, and for some, the choice between paying bills and buying food has become a reality. It can be upsetting to find your money doesn’t stretch far enough to cover

-

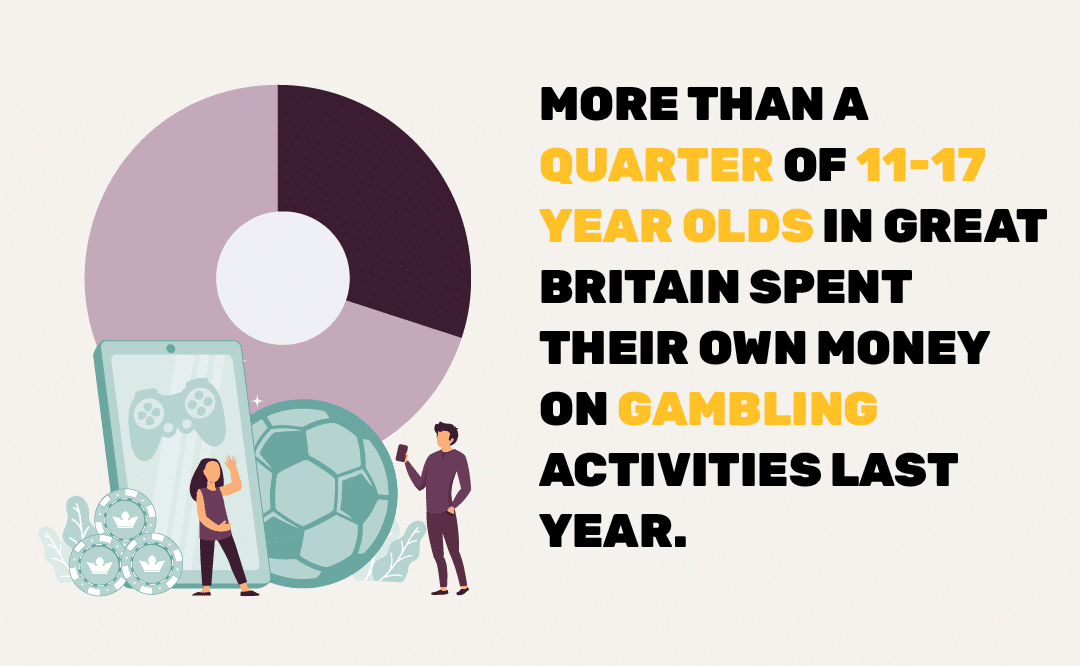

Parenting in the online age and keeping children safe from gambling

Children are spending more time online than ever before, and with that comes a whole new set of challenges for parents. One of the biggest is helping them understand the value of money in an online environment. According to the Gambling Commission, more than a quarter of 11-17 year olds in Great Britain spent their

-

Is money ruining my relationship: signs and solutions

When money problems creep into a relationship, they rarely begin with a row. More often, it starts with silence. One of you might be quietly worrying about missed payments. The other may be making spending choices without knowing the full picture. Over time, the silence can grow into distance, resentment, or mistrust. If you’re having

-

Feel stupid asking for debt help? You’re not alone

If you’ve ever thought, ‘I feel stupid about debt’ or ‘I’m ashamed of my money problems’, you’re far from the only one. Money troubles can make even the most confident person feel uncertain, ashamed, or worried about what others might think. It’s important to know that feeling this way doesn’t say anything about your worth,

-

Court letter for unpaid debt: what it means and what to do next

Receiving a court letter for unpaid debt can be worrying – especially if you’re unsure what it means or what you’re expected to do. If you’ve been sent a CCJ letter in the UK or another official notice, it’s important to act quickly. Ignoring a debt letter from court can make things worse, but the

close

MoneyPlus Advice Articles

You are here:

- Home

- MoneyPlus Advice Articles