-

How to pay down debt when living paycheck to paycheck

Many people across the UK live paycheck to paycheck. This means they rely on each payday just to get by. If you’re in this position, it can feel hard – or even impossible – to think about paying off debt. But even with a tight budget, there are steps you can take to start improving

-

Can a debt collector take money from my bank account?

Worried about a debt collector taking money straight from your bank account? You’re not alone. This is something many people feel concerned about, especially when they’re already feeling stressed about debt. The good news is that a debt collector cannot typically take money directly from your bank account without going through the proper legal steps.

-

How long does a CCJ last?

If you’ve received a County Court Judgment (CCJ) or think you might be at risk of one, you’re not alone. Thousands of people across the UK deal with CCJs every year, often as a result of financial difficulty or missed payments. In this guide, we explain exactly what a CCJ is, how it affects your

-

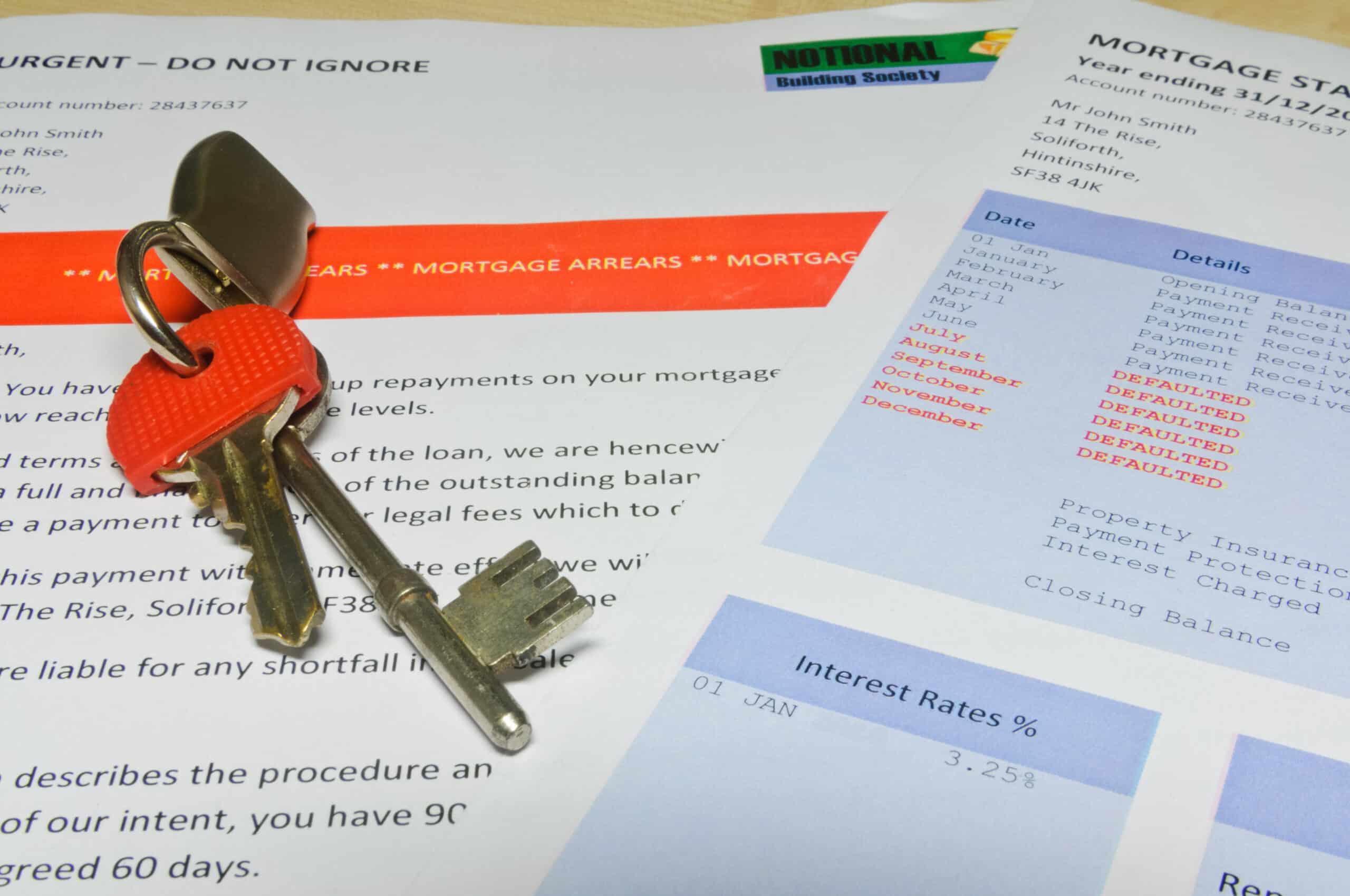

What happens if you can’t pay your mortgage?

Falling behind on your mortgage payments can be stressful – especially when the cost of living is already high. If you’ve missed a payment or are worried you might soon, you’re not alone. Many people are in the same position and need help understanding what comes next. In this guide, we explain what mortgage arrears

-

Equity Release: A debt management solution or a last resort?

If you own your home and have money worries, you might wonder if equity release can help. It’s a big decision that could affect your finances for years to come, so it’s important to understand how it works. Equity release lets you get cash from your home. It may sound like a quick fix, but

-

Protecting your finances from some of life’s biggest challenges

Life rarely goes exactly as planned, and when setbacks strike, they often carry a heavy financial cost. Whether it’s losing a job, an unexpected home repair, or dealing with divorce, some moments can unravel even the most carefully managed budgets. In some cases, these setbacks can lead to debt. If you’re struggling with debt, you’re

-

The Generational Gap of Finances

Financial security is often seen as a natural reward for getting older – the idea being that by midlife, people have climbed the career ladder, built up savings, and moved past big expenses like childcare and mortgage debt. However, new data from MoneyPlus challenges that narrative. Our latest survey suggests that Generation X – those

-

Should I get a second job to pay off debt?

When you’re struggling with debt, finding extra money to make repayments can feel overwhelming. Taking on a second job is one option many people consider, but is it the right approach for your situation? In this guide, we explore whether finding additional work makes sense for debt repayment, and suggest some practical ways to earn

-

Do single parents get financial help?: A complete guide to support and benefits

Raising a family as a single parent comes with a range of unique financial challenges that can often feel overwhelming. From additional childcare costs to managing a single income, balancing expenses can be a constant struggle. Fortunately, here in the UK there are a number of financial support mechanisms designed to help single parents cope

-

Debt management tips for carers

Caring for someone can be one of the most rewarding experiences life has to offer, but it can often come with significant financial challenges. Whether you’ve reduced your working hours to provide care or found yourself struggling to balance care costs with everyday bills, you’re not alone. Many of the UK’s 5.7 million carers find

-

How to plan a wedding on a budget

Planning a wedding in 2025 can feel like walking a tightrope between creating your dream day and protecting your financial future. With the cost of living continuing to rise and the price of organising a wedding following suit, more couples are looking for ways to celebrate without starting their marriage under a mountain of credit

-

The Expense of Living in 2025

Over the last 10 years, the UK has undergone significant changes, from political leadership to economic policies. The country today is vastly different than it was in 2014 – but how much have people’s daily lives and finances been affected? According to our survey, over 90% of people feel they have been impacted by changes

close

MoneyPlus Advice Articles

You are here:

- Home

- MoneyPlus Advice Articles