Financial security is often seen as a natural reward for getting older – the idea being that by midlife, people have climbed the career ladder, built up savings, and moved past big expenses like childcare and mortgage debt. However, new data from MoneyPlus challenges that narrative. Our latest survey suggests that Generation X – those aged between 45 and 60 – are among the most financially strained.

We asked three different age groups – Generation X (aged 45-60), Millennials (aged 29-44) and Generation Z (aged 18-28) – about how they approach their finances, specifically in relation to four key areas: holidays, retirement, lifestyle and debt.

What’s clear is that financial pressure doesn’t ease with age. In fact, many aged 45-60 are juggling the highest costs, and some may explore formal debt solutions such as Individual Voluntary Arrangements (IVAs) or Debt Management Plans (DMPs) to regain control of their finances.

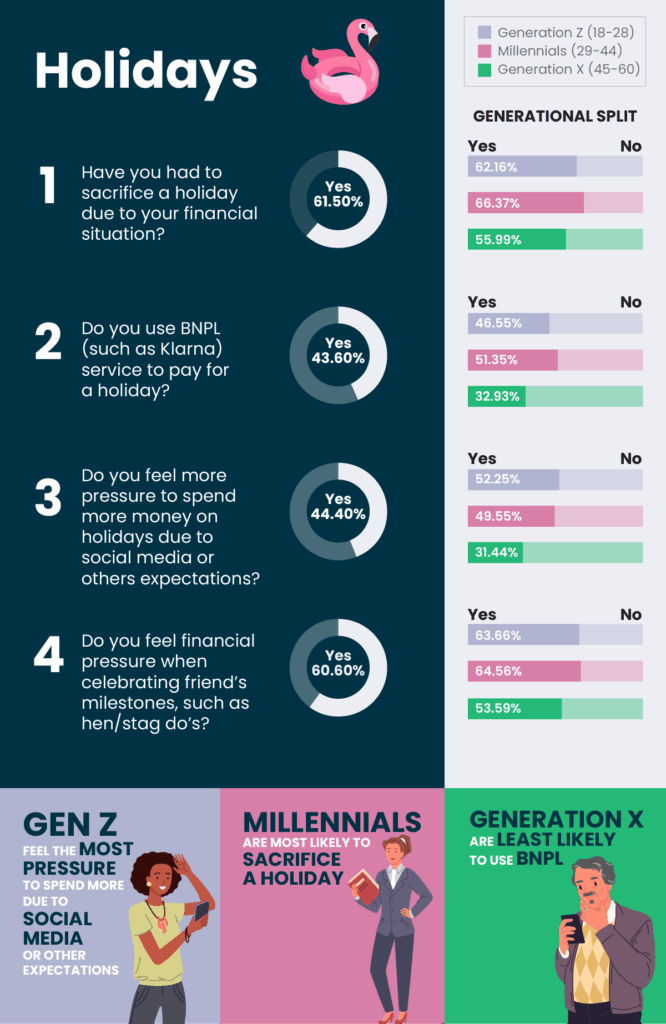

Holidays

One of the most unexpected findings from the survey is that over 60% of respondents across all age groups have had to give up a holiday due to financial reasons. Notably, 56% of Generation X – typically viewed as financially stable having reached midlife – have made this sacrifice. This challenges the assumption that older adults have more disposable income and are better equipped to handle financial pressures.

What’s more, our data suggests people across all generations may be foregoing their own holidays to afford milestone celebrations for others, such as baby showers and hen or stag dos. The pressure to splash out on these events has significantly increased in recent years. According to Aviva, in 2023, the average spend for a hen or stag do reached £779 for the UK and £1,200 for events abroad. Instead of a simple night out, these events have become more and more elaborate, partly due to the influence of social media on destination choices and activities.

Anel Andrew, an Insolvency Practitioner at MoneyPlus, commented on the dangers of social media on debt:

‘Social media makes it easy to compare yourself to others, but what we don’t see is the credit card debt or financial stress behind the luxury lifestyles. The pressure to ‘keep up’ can lead to overspending, taking on unnecessary debt, and prioritising short-term gratification over long-term financial security.’

Over 60% of respondents to our survey said they felt pressure to spend a lot on these events. While it’s no surprise that the younger generations – who are at the peak age for these celebrations – would feel this strain, the scale of it is striking. A significant 65% of Millennials and 64% of Generation Z reported feeling this pressure, highlighting how widespread and normalised these financial expectations have become.

Despite not being at peak age for such celebrations, over half (54%) of Generation X respondents also said they felt obliged to spend significant amounts on others’ milestones. Financial strain and social pressure to show up – and spend – for friends and family doesn’t necessarily ease with age.

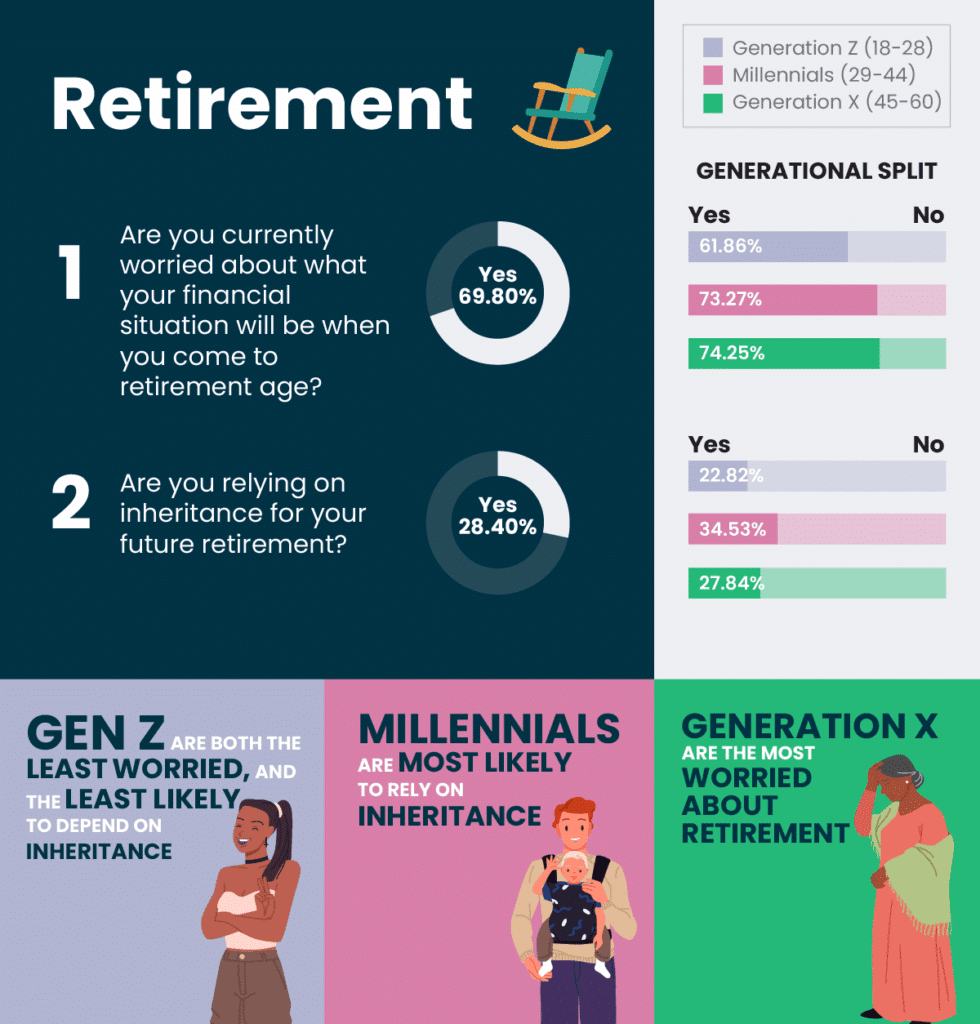

Retirement

It’s not only holidays that are causing financial struggle for Generation X. The prospect of retirement, often thought of as a time to enjoy the rewards of decades of hard work, is causing stress for many in this age bracket.

An alarming 74% of 45-60 year olds surveyed said they were worried about their financial situation in retirement, with nearly a third admitting they are relying on inheritance to support themselves later in life. This growing dependence on future windfalls – which are never guaranteed – highlights a lack of financial certainty.

In contrast, younger generations appear less concerned. 62% of 18-28 year olds said they worry about how they’ll fund their retirement – a significant number but lower than Generation X. This may reflect mindset more than circumstance. With retirement still decades away, many in this group may not yet consider the long-term consequences of financial habits. Optimism, or even denial, may be masking deeper risks, especially in an era of insecure work, high tuition fees and rising rent.

For Generation X, though, these concerns are far more immediate and often compounded by financial pressure in their daily lives.

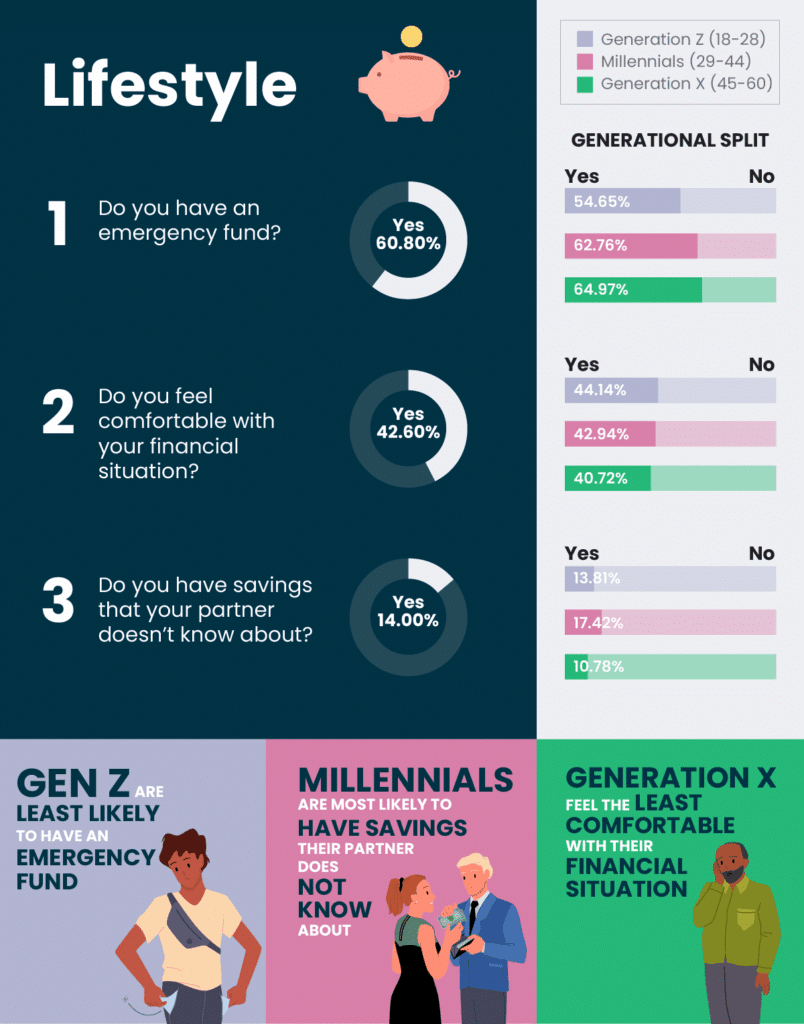

Lifestyle

Looking at day-to-day lifestyle, the cracks in the older generation’s finances become even more apparent. Almost 60% of Generation X said they were not comfortable with their current financial situation, underscoring how financial pressure is hitting this age group particularly hard.

Aged between 45 and 60, many are part of the so-called ‘sandwich generation’ – juggling the costs of supporting both ageing parents and dependent children, sometimes simultaneously. Some are paying university fees or helping children onto the property ladder, while others are covering long-term health expenses for their parents – facing care home costs that have risen by 19% between 2021 and 2023.

Interestingly, our survey also highlighted a high level of financial responsibility across all age groups, with over 60% stating that they have an emergency fund. This indicates that the majority of respondents are equipped to deal with large unexpected costs. While the percentage was higher for Millennials (63%) and Generation X (65%), a significant number of Generation Z (55%) are building a fund too.

But for Generation X, this financial preparation doesn’t equal peace of mind. Despite being the most likely to have an emergency fund, they are still facing high levels of uncertainty.

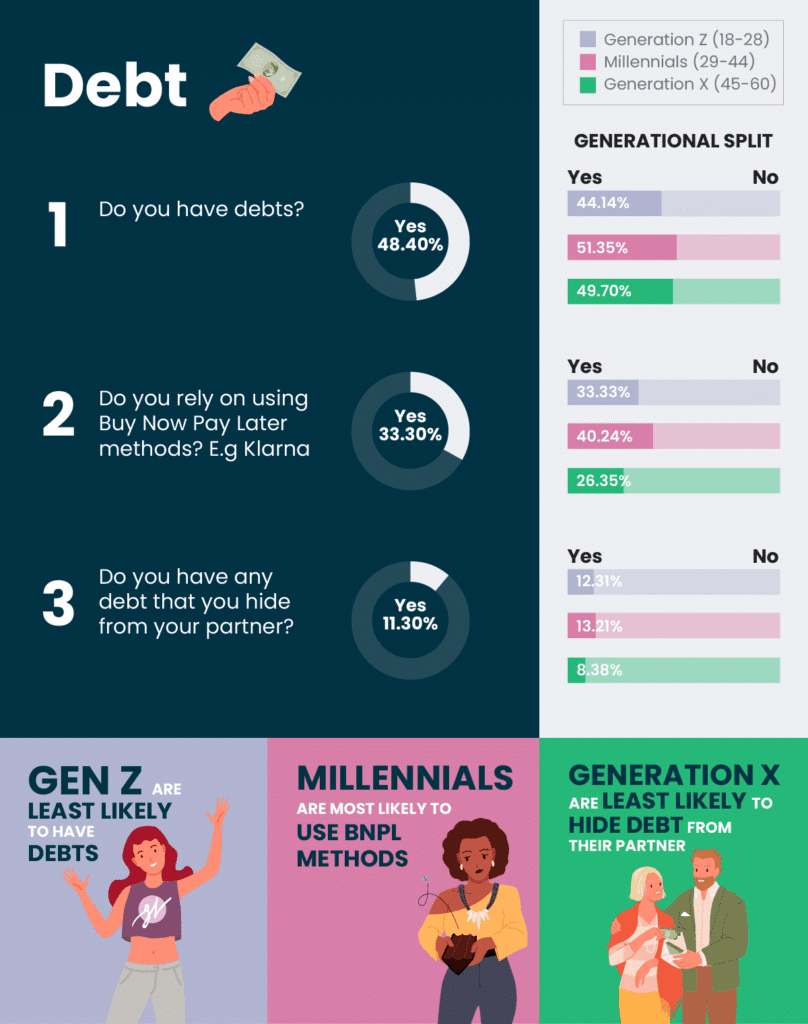

Debt

Debt is hitting every generation hard. Nearly half of Generation Z (44%), over half of Millennials (51%) and 50% of Generation X say they have debt – showing just how widespread the problem has become. The fact that almost half (48%) of respondents overall have debt signals the financial pressure many are under at the moment.

To deal with their debt and spread out payments, many are using Buy Now, Pay Later (BNPL) services such as Klarna and ClearPay, a form of credit where you borrow the money and repay it in instalments. Although methods like BNPL can be helpful for large purchases in some circumstances, they can also indicate issues with financial planning.

Unsurprisingly, BNPL is most popular among the younger generations, with 33% of Generation Z and 40% of Millennials admitting to using it. Over a quarter of Generation X (26%) use BNPL, which shows no generation is immune to the appeal, or necessity, of these credit options.

The uptake among Generation X may reflect the financial squeeze they’re facing, balancing everyday expenses with long-term responsibilities like mortgage payments, caring for relatives, and saving for retirement. While younger users may turn to BNPL due to lower incomes or lack of access to traditional credit, Generation X usage suggests that even those with more financial experience are feeling the pressure.

The generational gap in finances is not just about age – it’s about expectation versus reality.

What stands out most from this research is the extent to which people in midlife and beyond – once assumed to be on a good financial footing – are facing financial uncertainty.

It’s clear that financial difficulty doesn’t just affect one demographic. It touches students and single parents, young workers and midlife homeowners. If you are struggling, it’s important to get the debt help and advice you need.

To discover more about how to manage your debt and to receive free debt advice, you can visit www.moneyhelper.org.uk.