Life rarely goes exactly as planned, and when setbacks strike, they often carry a heavy financial cost. Whether it’s losing a job, an unexpected home repair, or dealing with divorce, some moments can unravel even the most carefully managed budgets. In some cases, these setbacks can lead to debt.

If you’re struggling with debt, you’re not alone. Millions of people across the UK are facing similar challenges, especially as the soaring cost of rent and the rising expense of care homes in later life continue to pile on the pressure.

Anel Andrew, Insolvency Practitioner at MoneyPlus, said: “At MoneyPlus, we’re here for the hard conversations – whether that’s about missed bills, money stress, or fears about the future. With 97%* of our clients saying our advice felt right for their situation, we know the right support can change everything”

To better understand how people experience these kinds of financial shocks, we conducted a survey asking 1,000 respondents about their opinions on some of life’s biggest setbacks. In this article, we explore how these challenges can impact your finances, and offer practical steps to help you prepare, adapt, and protect your future.

Dealing with job loss and surprise expenses

“Losing your job can feel like financial freefall, but it doesn’t have to be,” Anel says. “In 95% of our 2024 debt management cases, we’ve frozen interest and charges to give people space to breathe. That kind of headroom can be the lifeline people need.”

While job loss doesn’t automatically lead to debt, it can significantly increase financial vulnerability, especially if you have limited savings or there is a delay in accessing support such as Universal Credit, which typically has a five-week wait before the first payment.

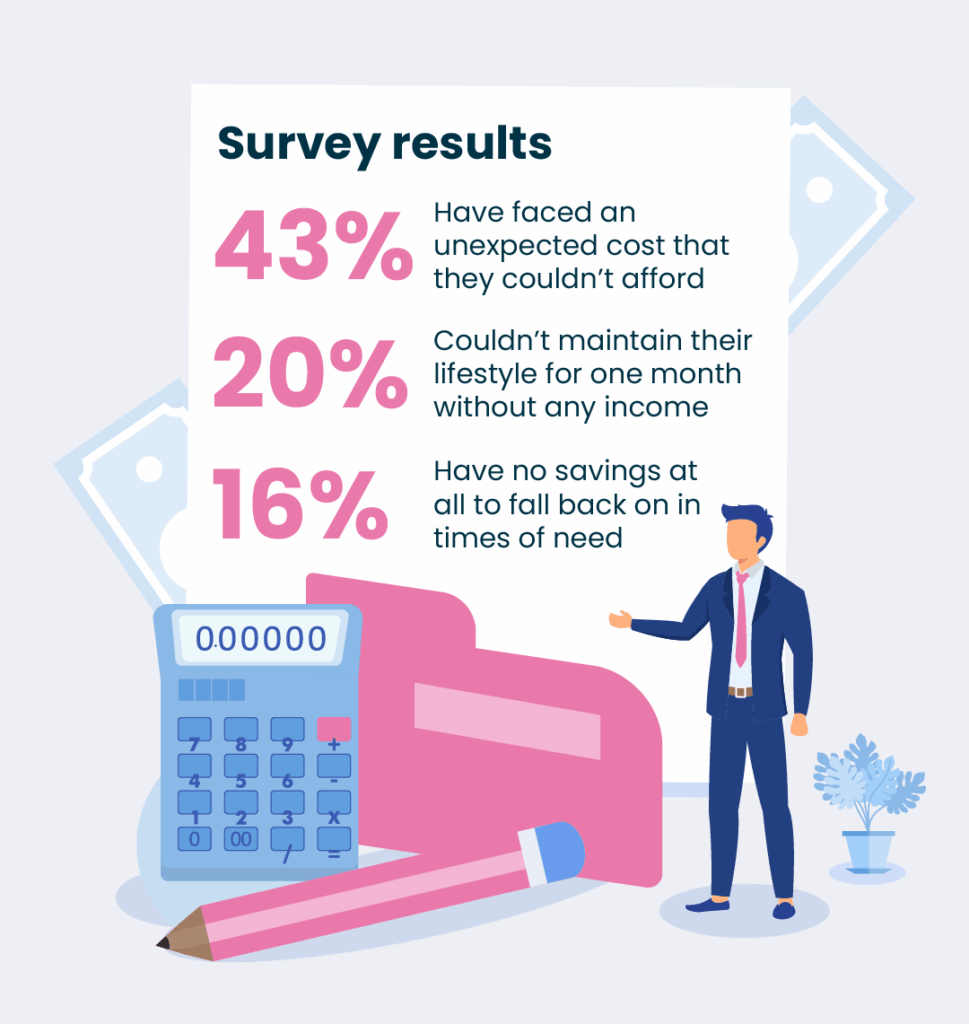

Losing a job or facing an unexpected expense such as an urgent home repair or car breakdown can hit hard, especially if you are living month to month. Our survey asked whether respondents had ever faced an unexpected cost that they couldn’t afford and almost half (43.6%) said yes. The age group most affected by this was 29-44 year olds (44.7%).

When asked how long they could maintain their lifestyle without an income, nearly a quarter said they could manage for over five months. Meanwhile, almost 20% admitted they wouldn’t last even one month. Age appears to play a significant role in financial resilience, with the majority of 18-28 year olds saying they could manage for up to three months, whereas most 29-44 and 45-60 year olds say they could maintain their lifestyle for five months or more.

When it comes to saving for unexpected expenses, nearly 30% of those surveyed have over £2,500 set aside, providing a valuable financial cushion. However, 16% have no savings at all to fall back on. Across all age groups, nearly 30% reported having more than £2,500 saved, highlighting a generally positive level of preparedness for emergencies.

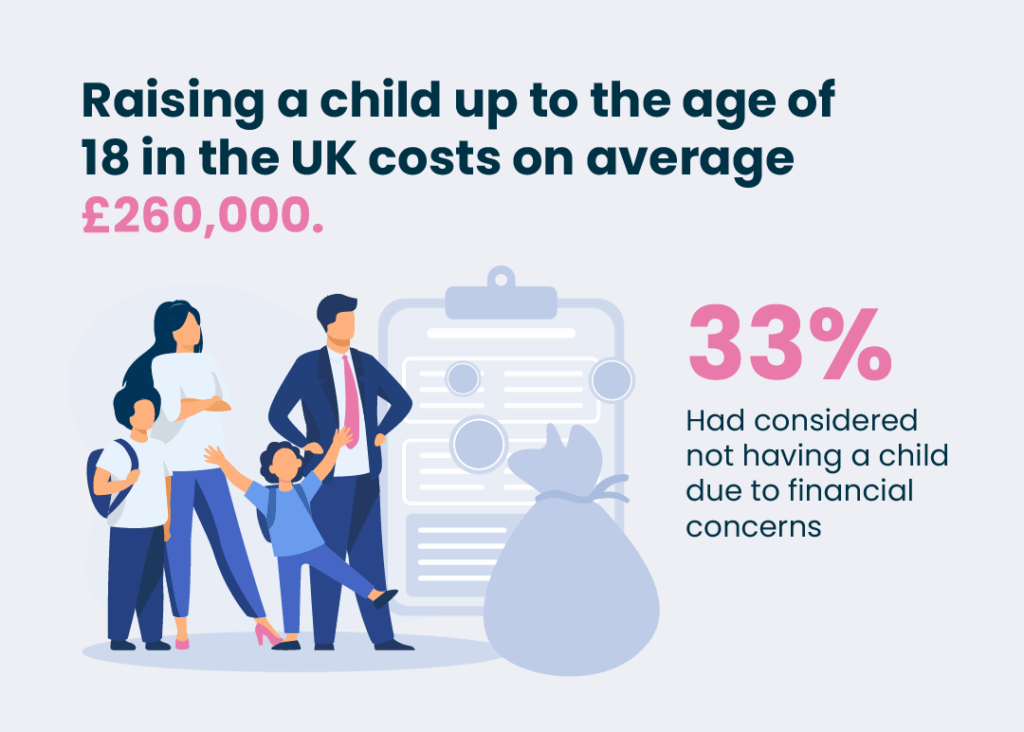

The financial reality of parenthood and the high price of raising a child alone

Raising a child up to the age of 18 in the UK costs on average £260,000, according to the Child Poverty Action Group. For single-parent households, where financial responsibilities rest on one income, the cost can rise significantly – up to £290,000. Childcare and everyday expenses can often take up a large portion of that budget. Limited access to flexible and part-time work can also reduce earning potential. To manage financial pressures and provide a stable home for your child, it’s important to budget carefully, find out what benefits you’re entitled to, and seek debt help when needed.

Our survey found that 33% of respondents had considered not having a child due to financial concerns.

Responses varied by age group. Most 45-60 year olds said they hadn’t considered delaying or forgoing children due to finances – perhaps reflecting lower living costs when they were younger. In contrast, nearly half of 18-28 year olds admitted they have considered not having children due to financial reasons.

Anel says: “Life events like having a baby don’t always come at the perfect financial moment. That’s why we provide guidance based on individual circumstances, and only recommend options like budgeting support or payment breaks where they’re appropriate.”

The rising cost of divorce in the UK and what it means for families

Divorce can be emotionally tough, but the financial impact can be just as challenging. In 2018, Aviva’s Family Finances Report showed that the average cost of a divorce in the UK stood at £14,561. This figure was arrived at by dividing the total estimated cost of divorce across the UK (approximately £1.7 billion) by the total number of divorcees (233,502 individuals from 116,751 annual divorces/dissolutions). It primarily includes expenses such as legal fees, the cost of setting up a new home and childcare. With inflation and rising legal fees, this figure is only going up.

Even after the immediate legal expenses, the long-term financial strain can still be significant. According to the Aviva report, people spent an average of 4.7 years renting after separation, often paying more for smaller, less secure housing. In addition, after a divorce, many families experience financial strain as one household splits into two, leading to double the bills without an increase in income.

For parents, the impact can be even harder. Childcare costs and the stress on children all add to the pressure. Planning ahead, choosing mediation instead of going to court (if this is possible in your situation), and getting financial advice early can help protect your money and your peace of mind.

How increasing rent and property prices are making housing less affordable

With property prices and rents continuing to rise in the UK, being forced to move can be extremely costly. Whether it’s due to divorce, job loss, or a change in personal circumstances, the financial impact can be significant.

Average rent rose by nearly 8% in the 12 months leading up to March 2025, reaching £1,386 per month. At the same time, the average house price climbed to £292,000, a 5.3% increase in England in the year to February.

People who suddenly need to find a new place to live can end up paying hundreds more each month compared to just a few years ago. Add in upfront costs like deposits, letting fees, and moving expenses, and the price of starting over quickly adds up.

In many cases, people are left renting smaller homes for more money, with little time to budget or plan. This can derail savings goals, increase debt, and make it harder to find long-term stability, especially for families or single-income households.

Having an emergency fund, staying informed about local rental markets, and seeking advice early can make a sudden move less financially overwhelming.

The growing expense of care homes and what it means for families facing sudden costs

Suddenly needing to arrange care for a loved one can lead to significant financial strain. The average residential care home now costs around £1,406 per week in the UK, with prices rising for specialised care and homes in certain areas.

These costs often come unexpectedly, like after illness or a hospital stay, and they can leave families scrambling to cover fees. With limited support and strict means-testing, many end up using savings or selling assets to pay for care.

To manage these costs more effectively, it’s important to plan ahead and explore available options:

- Start building a dedicated care savings pot early. Even small monthly contributions like £20-£50 can add up over time, especially when placed in tax-efficient accounts like ISAs. Platforms like Monzo offer “saving pots” that help you set aside money specifically for future care needs. Monzo also has a ‘Roundup’ feature that saves money for you by rounding up your purchases to the nearest pound.

- Consider residential care savings plans. Some providers offer specialised savings products designed to help cover future care costs, often combining flexible contributions with tax benefits and potential bonuses. These plans can provide peace of mind and a structured way to prepare financially for care needs.

- Understand what financial support is available. The UK government and local councils provide assessments to determine eligibility for care funding. Websites like Age UK and Citizens Advice offer detailed guidance on navigating these processes.

By planning ahead, staying informed about support options, and actively saving, families can minimise the financial pressure that sudden care needs can bring.

Building financial resilience

Major life events, such as job loss, raising children, divorce, or housing changes can significantly impact your financial stability. To help you get through these financial setbacks, building resilience through planning, saving, and seeking advice early is key.

Although some events can come unexpectedly, having a financial safety net and being informed about your options can help protect your wellbeing and future security. If you’re already dealing with unmanageable debt, a debt management plan or individual voluntary arrangement can offer breathing room and help you rebuild financial resilience over time.

Being prepared for these challenges not only helps you protect your financial future, but also gives you peace of mind.

*Based on a survey of 281 MoneyPlus customers, May 2025