If you’ve experienced a change in circumstances and found yourself in debt, it can be hard to find ways to budget and save money each month. Not only do you have to factor in paying towards monthly essentials such as mortgage or rent, utility bills, and groceries, but you may be paying off existing debts too and it can sometimes feel a little overwhelming and confusing.

One thing that might help to make budgeting easier is the so-called “50-30-20 rule”. This is designed to help you make some positive changes to your spending habits and keep track of where your money is going each month. If you’re unfamiliar with the 50-30-20 rule and how it can benefit you, we’re here to explain how it works and how you can apply it to help you budget your monthly outgoings.

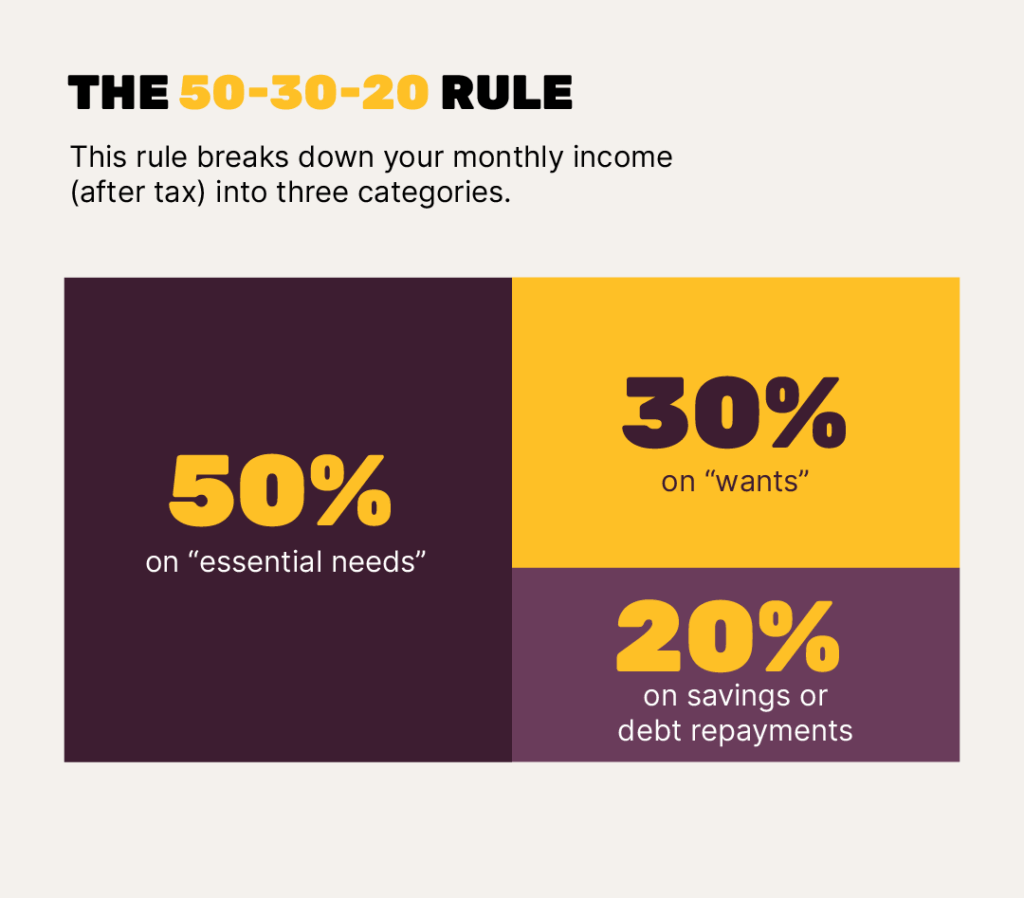

What is the 50-30-20 rule?

To make budgeting simple, there are three categories that your monthly income (after tax) can be broken down into:

- 50% on “essential needs”

- 30% on “wants”

- 20% on savings or debt repayments

Following a budgeting technique like the 50-30-20 rule can help you put money towards a saving goal, like a deposit for a house, a once-in-a-lifetime holiday, or a dream wedding.

Not only can you save money by following this rule, but it also allows you to budget better for your essential needs and wants.

So, which of your outgoings fall into the three different categories? Let’s take a look at each one in further detail.

50% towards essential needs

Essential needs are your outgoings that you can’t go without. Things that fall under this category include rent/mortgage, household bills (electricity, gas, water, broadband), food, transport to work, mobile phone contracts, minimum repayments for credit cards or loans, and insurance (for example, car or home).

30% towards wants

Wants are outgoings that you don’t necessarily need to get by, but things that you like to spend money on. These are non-essential expenses, so things like shopping for clothes, holidays, eating out or takeaways, subscriptions (Netflix, Spotify, Amazon Prime, for example), memberships, and gifts for celebrations (birthdays, Christmas, weddings, etc.).

20% towards savings or debt

The idea behind this technique is that you’ll have 20% left of your income to pay off any debts beyond the minimum repayments to help clear them faster, or to put into your savings. When you have a savings goal in mind, it helps you stay on course.

How can I apply the 50-30-20 rule to my monthly budget?

If you think the 50-30-20 rule sounds great and could benefit you, here’s how to apply it to help manage your monthly budget.

You’ll need to look at how much income you have each month, which will mainly be your salary if you’re working, but you may have other income which you should also take into account. If your salary varies each month, work out the average for the past three months.

Next, taking your bank statements from the past three months, work out your average monthly outgoings. Using the categories above, separate your expenses into each area.

Once you’ve assigned your monthly expenses to the specified categories (essential needs, wants, savings or debt), you can work out the percentage of your current spends for each category. This may not match up with the 50-30-20 rule, but it’s important to remember that everyone’s spending is different and won’t necessarily fit into these percentages.

However, if you’re hoping to follow the 50-30-20 model to help you pay off debts quicker or meet a savings goal a little faster, then this will allow you to see where changes can be made.

The 50-30-20 rule on an average UK salary

To help give you a better idea of how this budgeting process works, we’re going to look at the average UK salary and work out approximately how much could fall into each category.

According to the Office for National Statistics (ONS), the average UK weekly wage in October 2023 was £663, equivalent to around £34,476 per year for full-time employees. This works out at approximately £27,904 after tax, so monthly you would have about £2,325 take-home pay.

Based on this average UK salary and using the 50-30-20 rule, you could spend:

- £1,162.50 on essential needs

- £697.50 on wants

- £465 on savings or debt

Dashly recently released research that stated the average monthly mortgage payment in August 2023 was £747. This would leave a person earning the average UK salary with £415.50 to spend on other essentials like water, electricity and food.

Using data from NimbleFins, we’ve worked out that the average monthly food cost per person is £136. As of 1st October 2023, the average monthly gas bill was £66.03 and the average monthly electricity bill was £61.54, according to Uswitch. Based on these figures, there would be approximately £151 left to spend on remaining essentials like travelling to work, a mobile phone contract, and broadband.

Hopefully, by breaking down these numbers, we’ve given you an idea of how to apply the 50-30-20 rule to your monthly income.

The takeaway

The purpose of the 50-30-20 rule is to help you manage your monthly outgoings, see where you can make positive changes to your spending and budgeting, and take control of your finances. When your income is split into each category, not only does it give a clearer representation of how much money you have to spend on different things, but it also enables you to be more mindful of your money.

Many people struggle with money management, especially in these tough financial times. Now more than ever, it’s important to plan for your future and budget towards savings goals like a deposit on a house, a new car, or a holiday.