Financial literacy is the ability to understand and manage finances effectively. In today’s world, where personal debt has become a common part of everyday life, understanding and managing finances wisely is more important than ever.

This article draws on the insights from the recent report titled Problem Debt in the Cost of Living and Beyond by MoneyPlus and Etic Lab (a digital research and design consultancy). It explores the importance of financial literacy, the challenges posed by problem debt, and the steps that can be taken to improve financial education and reduce the stigma associated with debt.

Why is financial literacy important?

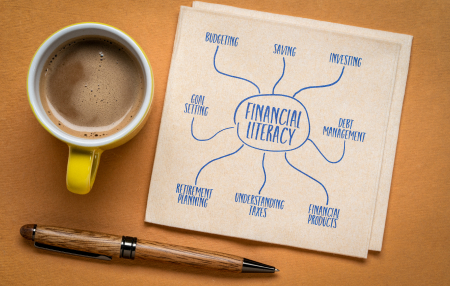

Financial literacy helps you understand how to budget, save, invest, and use credit wisely. When people understand these basics, they can make better choices to avoid or manage debt more effectively.

Key aspects of financial literacy include:

- Budgeting: Creating a plan for how you will spend and save your money.

- Saving: Setting aside money for future needs and emergencies.

- Investing: Growing your money by putting it into assets like stocks, bonds, or real estate.

- Managing debt: Understanding how to borrow responsibly and pay off loans effectively.

- Understanding financial products: knowing how different financial products like credit cards, loans, and insurance work.

However, due to a lack of financial education, many people don’t have a strong understanding of financial basics, leading to poor financial decisions. This can trap people in a cycle of debt, where they keep borrowing money without a clear plan to pay it back.

How attitudes towards debt have changed

In the past, taking on debt was often seen as a last resort and something to be avoided whenever possible. People were more cautious about borrowing money and usually only did so for essential purposes like a home or a car.

Today, debt has become a routine part of life for many. It’s now common for people to use credit cards, personal loans, and Buy Now, Pay Later services like Klarna and Afterpay for everyday purchases. This shift has been driven by the increased availability and convenience of borrowing options, making it easier for people to access credit.

While it’s easier now to get loans and credit, this has led to a growing personal debt crisis in the UK. More and more people find themselves unable to avoid debt, which could have serious effects on their financial stability and mental health.

Understanding problem debt

Problem debt is a complex issue that affects many aspects of an individual’s life. Managing debt requires a significant amount of financial literacy and the ability to plan for future challenges. It involves prioritising spending, making difficult decisions, and often making sacrifices that impact both the individual and their family.

Nearly one in five (18%) individuals with mental health issues are dealing with problem debt. Those with mental health problems are three and a half times more likely to face problem debt than those without.

The fact that debt and health problems often occur together shows that we need to tackle both the money issues and the emotional stress that comes with managing debt.

Overcoming the shame of debt

In addition to understanding money, it’s important to address the shame that often comes with debt. This shame can stop people from asking for help when they need it. Feeling embarrassed about debt can prevent them from getting the support they need to manage their finances.

Reducing the stigma around debt means changing how we talk about it. We need to create a culture where people feel comfortable discussing their financial struggles without feeling judged. This change can be helped by public awareness campaigns, education initiatives, and supportive policies that make it normal to talk about debt and financial health.

The role of the Financial Conduct Authority (FCA)

The FCA has reminded borrowers that they can seek help from their lenders if they’re struggling to keep up with payments. This reminder comes as the number of people having difficulty meeting bills and credit repayments has increased by 3.1 million since May 2022.

To address this issue, the FCA has contacted 3,500 industry lenders to emphasise the importance of supporting their customers and working together to resolve payment problems. This initiative aims to encourage creditors to consider each borrower’s situation and explore ways to assist them when payments are missed.

By addressing debt problems early, the negative impact on individuals’ mental and financial well-being can be minimised. Early identification of issues and providing appropriate support can help borrowers regain control of their finances, ultimately leading to a more stable future.

The “No Shame in Saying” campaign by MoneyPlus

MoneyPlus has launched the “No Shame in Saying” campaign to encourage conversations about financial health and to support better financial education in schools and communities. This campaign aims to raise awareness, provide resources, and help people take control of their finances.

The campaign emphasises the importance of cooperation between creditors, advice providers, and Government agencies to create a supportive environment for those dealing with debt.

With a general election due in 2024, MoneyPlus will introduce “No Shame in Saying” into schools through a program called Friday Finance. This program will provide downloadable resources to help teachers dedicate one hour a month on a Friday to teach children about the importance of managing finances.

Topics will include:

- How to save

- How to use a bank account

- How to handle credit

- How to make money

- Where to seek out money advice, and why

MoneyPlus will share more details about the campaign in the coming weeks.

Key takeaways

Understanding how to manage money is essential for dealing with the financial challenges of today. With personal debt on the rise in the UK, it’s more important than ever to teach people how to handle their finances. Addressing the shame associated with debt and improving financial education are key to making this happen.

MoneyPlus’ “No Shame in Saying” campaign is an important effort to encourage open discussions about financial health and support better financial education. By working together and focusing on early help, we can create a more supportive environment for those dealing with debt.

The goal is to enable individuals to take charge of their financial futures and seek help when they need it. By doing so, we can work towards a society where financial stability is possible for everyone.

If you’d like to read more on problem debt, you can download the Etic Lab and MoneyPlus report, Problem Debt in the Cost of Living and Beyond report, or listen to the podcast.

To discover more about how to manage your debt and to receive free debt advice, you can visit www.moneyhelper.org.uk.