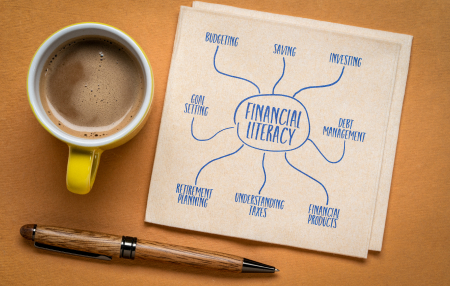

Generation Debt: What Is Financial Literacy?

Financial literacy is the ability to understand and manage finances effectively. In today’s world, where personal debt has become a common part of everyday life, understanding and managing finances wisely is more important than ever. This article draws on the insights from the recent report titled Problem Debt in the Cost of Living and Beyond…