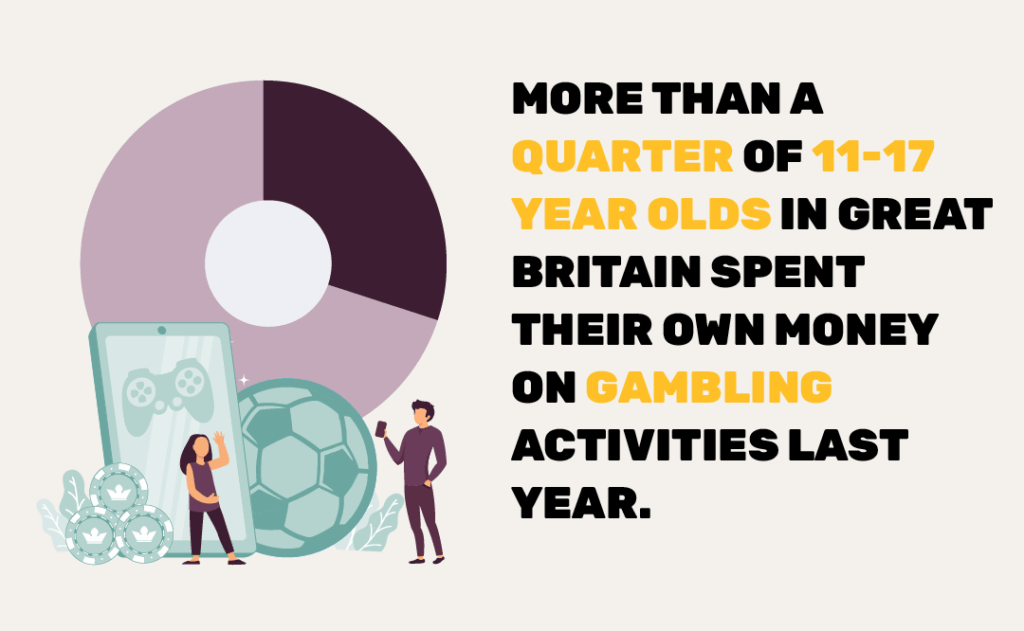

Children are spending more time online than ever before, and with that comes a whole new set of challenges for parents. One of the biggest is helping them understand the value of money in an online environment. According to the Gambling Commission, more than a quarter of 11-17 year olds in Great Britain spent their own money on gambling activities last year. Many more are facing financial risks through online gaming. That’s why it’s so important for parents to stay informed and take simple steps to guide and protect their children.

Anel Andrew, Insolvency Practitioner at MoneyPlus, said “We often support people whose own gambling has led to problem debt. The same psychological triggers – chasing wins, spending without noticing, and the stress that follows – are also present in gaming features like loot boxes. That’s why early conversations with children about spending and limits are so important.”

Whether it’s arcade games, casual bets with family and friends, or the growing trend of loot boxes in popular video games, children are coming across gambling-like behaviour earlier than ever. While these games may seem harmless at first, the truth is that they can lead to real financial problems. Some of these games encourage children to spend money without them fully understanding the true cost. In some cases, kids have spent money without their parents even knowing. This can have serious consequences for the child and the whole family.

With the right information and support, you can help your child build safer habits online and protect your family’s finances at the same time. At MoneyPlus, we know how quickly small, unnoticed spending can add up. Especially when it’s happening in the background, through apps, games, and online purchases.

It can feel overwhelming, but you don’t have to figure it out on your own. This article offers clear, practical advice on how to monitor your child’s online gaming habits and keep your finances secure.

How gambling looks different for today’s young people

When people think of gambling, it’s usually casinos or betting shops. But for many children today, gambling looks very different and is happening in places parents might not expect. One big change is online gaming, which can often involve spending money in ways that feel like gambling. An example of this is loot boxes, which are virtual “boxes” in games like Fortnite or FIFA. Players buy them to get random rewards and you can pay with in-game money or real cash.

Loot boxes aren’t officially classified as gambling by the UK government, but they closely resemble it – encouraging players to spend money for random rewards. This similarity worries many experts and parents. According to research from Gambling Health Alliance (GHA), around 15% of young gamers have taken money from their parents without permission to buy loot boxes, a worrying trend that can lead to financial strain on families.

The UK’s gaming industry is huge, making over £6 billion a year. For 16-24 year olds, 83% report playing games online, which shows how online gaming is a big part of young people’s lives. Parents need to understand how these games can affect spending habits and expose kids to gambling risks.

Knowing that gambling isn’t limited to casinos and betting shops anymore is important. It helps parents stay alert and protect their family’s money.

Understanding the risks and how they can impact your family

Many children are spending money online without understanding the full impact it can have. Sometimes they don’t realise they’re spending real money, especially if it’s linked to a parent’s bank card.

Worryingly, the GHA found that 1 in 10 children borrowed money they couldn’t repay to buy loot boxes, while others had taken money from their parents without asking. These moments might seem like one-off mistakes, but they can quickly lead to bigger problems.

Some families only realise there’s an issue when unexpected charges start showing up on bank statements, and some parents only become aware once the damage is already done.

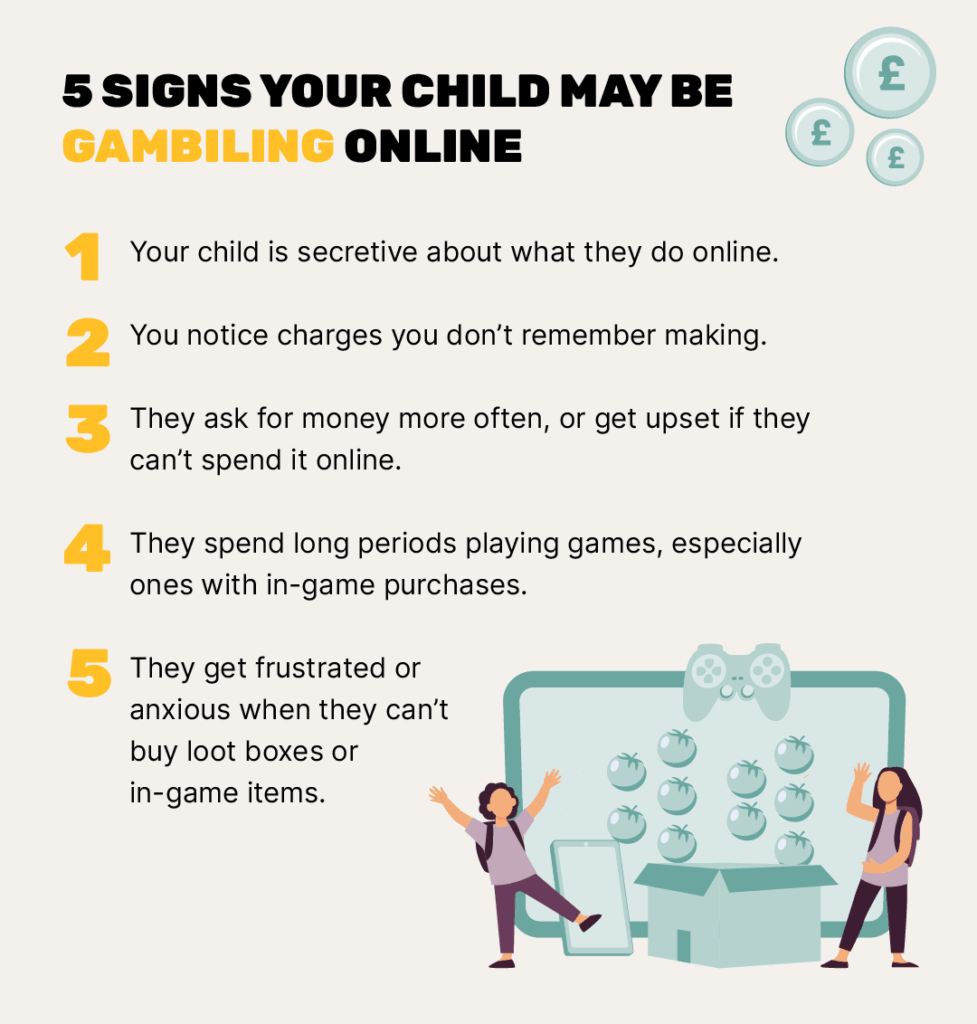

These risks aren’t always easy to spot, but here are some of the signs to look out for:

Without proper guidance, children can fall into habits that affect both their own future and their family’s finances. This is why it’s so important for parents to stay involved. Understanding what’s happening now can help prevent bigger issues later. If your child’s online spending has already caused financial strain, you may be wondering if it’s possible to write off debt. The good news is that help is available.

Supporting your child while protecting your finances

You don’t need to know everything about online gaming to help your child stay safe. A few simple habits can help make a difference. At MoneyPlus, we understand how easy it is for small digital purchases to build up, especially when they go unnoticed. Here are some key ways you can stay informed and involved:

- Check your bank statements regularly

Look out for unfamiliar charges, especially from gaming platforms like Xbox, PlayStation, Steam, or app stores. These can sometimes go unnoticed for weeks or months.

- Set up purchase notifications

Many banks offer instant alerts for card spending. This means you’ll be notified when a payment is made, so nothing slips through without your knowledge.

- Use parental controls and spending limits

Most consoles and games allow you to block or restrict in-game purchases. You can also set up limits that require approval before any money is spent.

- Have regular, calm conversations about money

Talk to your child about how much things cost and how online games work. Keep the tone open and judgement-free to help build and encourage honesty.

- Set screen time rules

Gaming for long periods can make it easier to lose track of spending money. Creating clear boundaries around when and how long your child plays can help them stay in control.

- Involve your child in budgeting

If your child gets pocket money or an allowance, teach them to track their spending. This can help them understand the value of money, both online and offline.

If you’re already seeing the financial consequences of online overspending, it may be worth exploring debt help solutions or a Debt Management Plan (DMP). These options aren’t right for everyone, so it’s important to weigh the pros and cons of a DMP or any other debt solution before making any decisions.

Keeping your family on the right track

Protecting your family’s finances in a world of apps and online games can feel overwhelming. But remember, you’re not alone and many parents face the same challenges. With the right tools and advice, you can help your child stay safe while they game, browse, and explore.

At MoneyPlus, we’re here to help you every step of the way. If you ever feel that gambling-related spending or debt is becoming a problem in your household, don’t hesitate to seek advice.

Teaching children good money habits now can help lead to better money decisions in the future. With your support, they can enjoy gaming and online activities without putting themselves or your family’s finances at risk.