With the new Labour Government in power, shifts are on the horizon that may impact your finances. Labour’s manifesto has outlined several key changes, and these will bring about both benefits and challenges for individuals and families across the UK. Here, we break down five financial changes you can expect under Labour’s leadership.

1. State pension will continue to rise

One of the most significant promises Labour has made is to maintain the state pension “triple-lock.” This will ensure that the state pension increases annually by the highest of three measures:

- Average earnings growth

- Inflation

- Or 2.5%

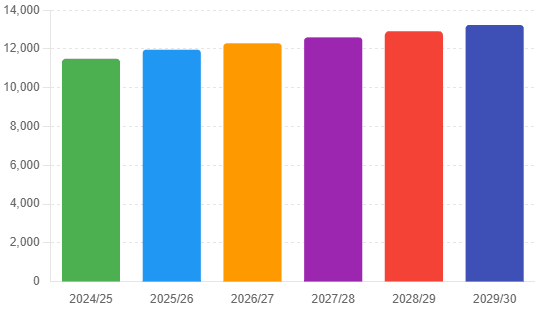

For instance, based on current forecasts, the full new state pension is set to reach nearly £12,000 next year and could be worth almost £13,250 by 2030. However, it’s worth noting that while the state pension is set to rise, Labour has not promised to shield it from income tax. As a result, pensioners might find themselves paying tax on their state pension due to frozen tax bands.

Expected growth of state pension

For more on pensions, see Can You Retire If You Are in Debt.

2. Income tax allowances will remain frozen

Labour has committed to keeping income tax rates unchanged, but they have also chosen not to end the freeze on income tax thresholds initiated by the previous Conservative Government. This decision effectively results in a “stealth” tax increase.

Since income tax bands are frozen, as people’s earnings rise due to inflation and wage increases, more individuals will find themselves moving into higher tax brackets. For example, if tax bands had been adjusted for inflation, the personal allowance would be just over £15,000 this year, rather than the current £12,750.

Consequently, millions more people are paying tax than they would’ve if the thresholds weren’t frozen. This policy is expected to generate significant additional revenue for the Government, but at the expense of taxpayers’ disposable income.

3. VAT on private school fees

Labour plans to introduce VAT on private school fees, which will significantly impact families who send their children to these schools. This policy aims to raise additional funds for public education but will make private education more expensive.

For a typical day-school charging around £18,064 per year, adding VAT could increase costs by about 20%, raising the fee to over £21,600. For a family with two children, this could mean an additional £7,000 per year if schools pass on the full VAT increase.

Some schools might absorb part of the cost increase, but parents should still expect a substantial hike in fees.

4. Higher minimum wage for younger workers

Labour has pledged to extend the full National Minimum Wage to workers aged 18 and over, a move that will significantly benefit younger employees. Currently, the full minimum wage applies only to those aged 21 and over.

Labour’s policy means that an 18-year-old, who might currently earn £8.20 per hour, could see their hourly wage increase to £11.44, aligning with the rate for older workers.

For a full-time worker on a 35-hour week, this wage would result in an annual salary increase of over £5,000. This boost in income will help young workers meet their living expenses more comfortably.

5. Introduction of the UK ISA

Labour’s expected to continue with the Conservative policy of introducing the UK ISA, a new type of Individual Savings Account aimed at encouraging investment in UK companies. This account would offer an additional £5,000 ISA allowance, specially ring-fenced for investments in domestic businesses.

While the details are still being worked out, this initiative could provide a significant boost to UK companies by increasing the flow of capital. However, Labour has also expressed interest in simplifying the existing ISA system to encourage greater use of Stocks and Shares ISAs, which could mean that the UK ISA might be integrated into larger reforms aimed at making investment more accessible and appealing to the public.

The new Labour Government is set to introduce several financial challenges that will impact different aspects of personal finance.

From rising state pensions and higher minimum wages for younger workers, to increased private school fees and frozen income tax thresholds, these policies will shape the economic landscape in the coming years. Staying informed and planning accordingly can help you manage your finances effectively.

If you’re struggling with your finances and you’d like to discuss possible debt solutions such as Individual Voluntary Arrangements (IVAs) and Debt Management Plans (DMPs), our expert advisors at MoneyPlus can help.

To discover more about how to manage your debt and to receive free debt advice, you can visit www.moneyhelper.org.uk.