Struggling with Debt?

Reduce Debt with One Affordable Monthly Payment*

*Please see below for what debts can be included in a DMP.

If you enter a solution with MoneyPlus we will charge you fees. If you do not enter a solution managed by us, there will be no fee for the advice that we provide. All fees and risks will be explained in full before you enter into a solution.

To find out more about managing your debt and receiving free debt advice visit www.moneyhelper.org.uk or read Options for paying off your debt.

Awards and memberships

Take the first step toward controlling your debts today.

Debts causing you stress?

We offer expert debt advice and support to everyone who gets in touch.

Getting hassled by creditors?

With an approved IVA, you can say goodbye to creditor calls, letters, and home visits. Get peace of mind with legal protection from your creditors.

Looking to pay one monthly payment?

We’ll negotiate with your creditors so you have just one affordable payment each month.

Find the right debt solution in as little as 15 minutes

Here’s our most popular debt solutions

A flexible debt solution

Debt Management Plan

With a Debt Management Plan (DMP), you come to an informal agreement with your creditors to repay the money you owe. Our specialists will help you calculate how much you can afford and then you’ll make one set repayment per month. This money is divided between your creditors. A DMP isn’t insolvency. You aren’t tied in for a minimum period, and if your financial circumstances change, you can alter your repayment plan.

Protect your home from repossession

Individual Voluntary Arrangement

An IVA is a legally binding agreement that you reach with your creditors. Under an Individual Voluntary Arrangement, you pay an affordable monthly sum over a fixed period of time. This is usually 5 or 6 years. Any debt included in the IVA that remains after this point is written off.

The median average debt written off by our customers who completed their IVA in 2024 was 72%.

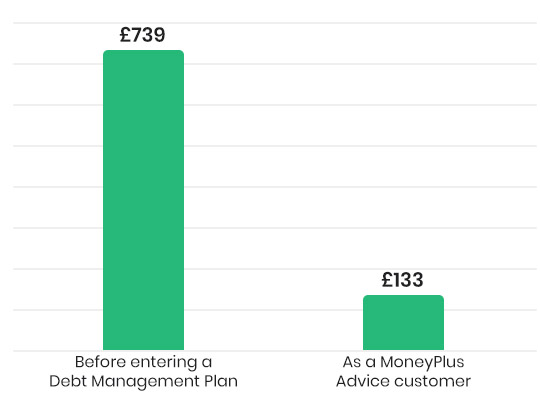

Example Debt Management Plan.

Melanie was £22,000 in debt

She had multiple debts including credit cards, loans, catalogues & buy-now-pay-later debts.

🎉 That’s a payment reduction of £606!

Monthly payments are based on your individual circumstances after a full review of income and expenditure. In a DMP, reducing your payments will extend the amount of time to pay and monthly Management Fees will be payable.

How it works.

We try to make your life as easy as possible, so we do as much of the work for you as we can. If you qualify here’s what happens when you get in touch:

Speak to us.

Tell us about your finances and the debts you’re having problems with.

Find a solution.

Based on your circumstances we’ll build a plan to get you out of debt, whether that’s with us, or not.

Choose your plan.

If you’re using our managed solutions, we’ll reach out to your creditors and tell them you’re with MoneyPlus. If not, we’ll make sure you know who can help.

What Debts Do A Debt Management Plan Cover?

Buy now, pay later

Overdrafts

Credit cards

Store cards

Payday loans

Bank loans

“I really cannot speak too highly of MoneyPlus, they literally saved my life.”

Stuart, Norfolk

Why Choose MoneyPlus Advice?

£18,000+

People provided with advice

Jan 2023 – May 2024

£305,000+

Unmanageable debt written-off for vulnerable customers

Jan 2023 – May 2024

£19,170

Average total debt per customer on a plan

Jan 2023 – May 2024