Why Choose MoneyPlus Advice?

21,820

People provided with debt advice in 2024

DMP customers Jan 2024 – Dec 2024

95%

Percentage of DMP customer debts that have interest and charges frozen

DMP customers Jan 2024 -Dec 2024

£19,203

Average total debt of new DMP customers in 2024

DMP customers Jan 2024 -Dec 2024

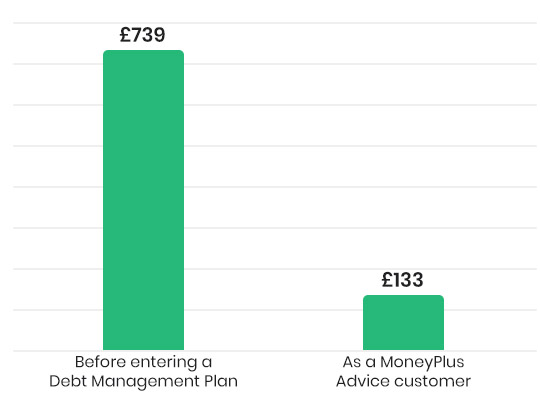

Example Debt Management Plan.

Melanie was £22,000 in debt*

She had multiple debts including credit cards, loans, catalogues & buy-now-pay-later debts.

*Names and images have been changed to maintain customer privacy, testimonies are from real customers

🎉 That’s a payment reduction of £606!

Monthly payments are based on your individual circumstances after a full review of income and expenditure. In a DMP, reducing your payments will extend the amount of time to pay and monthly Management Fees will be payable.

Support and guidance

We offer debt advice and support to everyone who gets in touch.

Potentially stop creditor contact

Although not guaranteed, some solutions will stop all contact from creditors.

Reduce interest and charges

We’ll always aim to freeze interest and charges, and we succeed over 95% of the time.

How it works

At MoneyPlus, we aim to make life as easy as possible. That’s why we take care of as much of the work for you as we possibly can. If you qualify for our DMP services, here’s what will happen next:

Talk to us.

Talk to us in complete confidence about your financial situation and the debts you are struggling with.

Find a solution.

Based on the information you give us, we will create a plan that will help you get out of debt, whether that includes our services or not.

Choose your plan.

We will get in touch with your creditors on your behalf to notify them that you are with MoneyPlus. Alternatively, we will ensure that you know who can help.

What debts does a Debt Management Plan cover?

Buy now, pay later

Overdrafts

Credit cards

Store cards

Payday loans

Bank loans

Can a Debt Management Plan protect me against bailiffs?

While a Debt Management Plan cannot guarantee that bailiffs will no longer come to your door, having an agreed repayment plan in place could help keep your assets safe.

As bailiffs are typically a last resort for lenders, setting up a Debt Management Plan is usually an indication that you plan to repay your debts, and should reduce the risk of legal force.

“It’s made a big difference to me and how I live.“

— Helen, Aberdeenshire *

Read Helen’s story…

*Names and images have been swapped to maintain privacy, but testimonies are from real customers