Over the last 10 years, the UK has undergone significant changes, from political leadership to economic policies. The country today is vastly different than it was in 2014 – but how much have people’s daily lives and finances been affected?

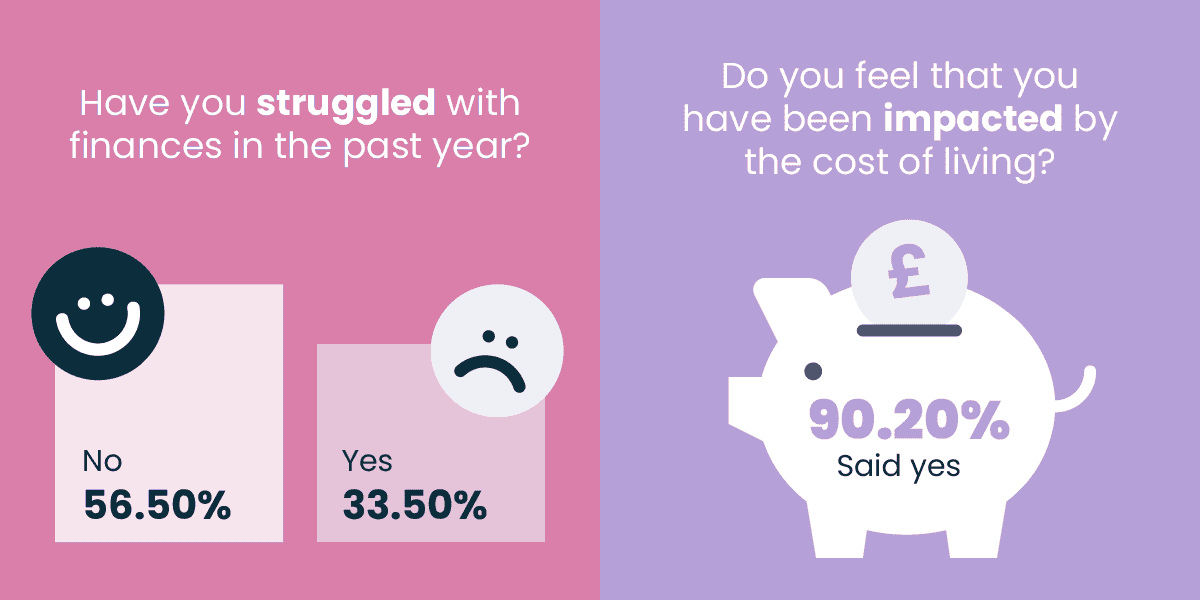

According to our survey, over 90% of people feel they have been impacted by changes in the cost of living, from housing affordability to energy bills and grocery prices. With the Cost of Living Crisis still ongoing, we at MoneyPlus set out to explore how daily expenses are affecting people today compared to 10 years ago.

To do this, we analysed price changes between 2014 and 2024 and surveyed individuals across the UK to understand how these changes have affected daily life. This article discusses our findings, providing a clear picture of the cost of living in the UK over the span of a decade.

How prices have changed over the past 10 years

So exactly how much have prices changed over the past decade? Let’s take a look. We checked how much basic food items cost in 2024 using prices from Aldi, ranked the cheapest supermarket in the UK by Which?. Unfortunately, the Consumer Price Index (CPI), the main measure of inflation in the UK, for these items only dates back to 2015. We have therefore used the CPI available from the Office for National Statistics (ONS) to estimate and compare costs between these two years.

| Item | Cost in 2024 | Cost in 2015 |

| 2 pints milk | £1.20 | £0.80 |

| 250g unsalted butter | £1.99 | £1.24 |

| 280g basmati rice | £0.99 | £0.82 |

| 600g beef mince | £4.79 | £3.96 |

| 1kg chicken breast | £6.49 | £5.47 |

| 500ml olive oil | £4.49 | £1.52 |

| 12 eggs | £2.35 | £1.86 |

| 400g sliced ham | £2.39 | £1.59 |

| 6 pack of apples | £1.19 | £1.07 |

| 400g cheddar cheese | £2.69 | £2.46 |

Although some items may not seem like they’ve risen by a lot, it’s important to note that this rate of inflation is much higher than in previous decades. For example, according to the Bank of England, the cost of a pint of milk was 25p in 1990 and 42p in 2020. This is an increase of 17p across 30 years. However, in December 2024, the ONS indicated that the cost for a pint of milk was 65p. This is an increase of 23p in just four years.

It’s therefore not surprising that nearly 90% of those surveyed said they’d spent more in 2024 than 2014. While the average annual salary has gone up by approximately 35%, people are having to spend a greater proportion of their earnings on essentials like groceries, which have on average increased by 46%.

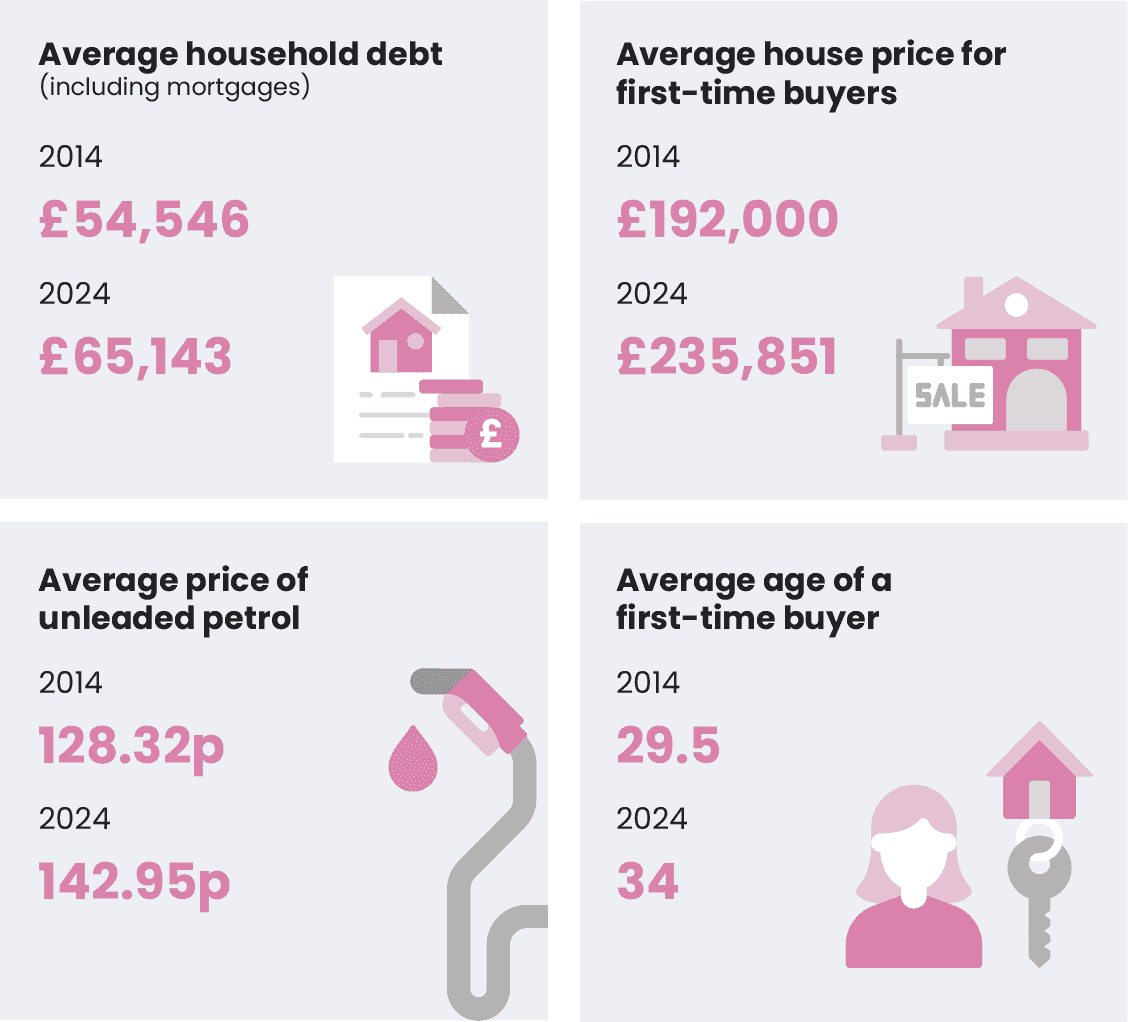

In addition to food items, we also looked at rises in average household debt (including mortgages), the price of unleaded petrol, the average age of first time buyers, along with how house prices have increased.

Our research shows that as costs have increased so too has household debt. Over the past ten years, the average price of petrol has risen by 11.4%, the price of a pint of milk by 41.3% and the average house price for first-time buyers by 22.8%. As a result, household debt has increased by 19.4%.

How the Cost of Living Crisis has affected different regions

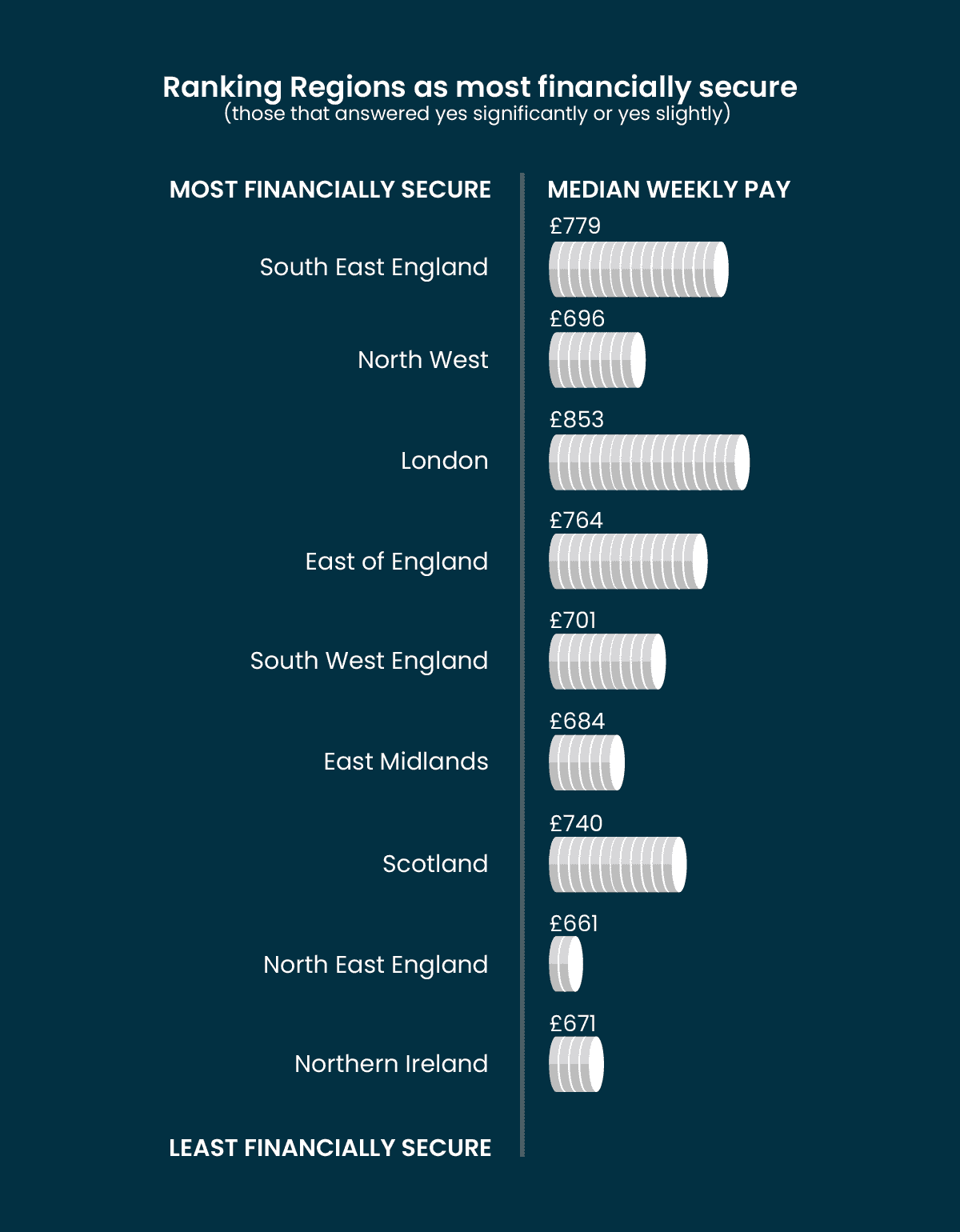

We also found that, depending on where you live in the UK, the Cost of Living Crisis may impact you differently. We compared the median weekly pay per region as of April 2024 with how the cost of living has impacted each region’s ability to meet their financial needs.

To measure the impact, we asked our respondents ‘has the increase in the cost of living in recent years affected your ability to meet your financial needs?’. Below, we have ranked the regions from most to least financially secure, based on how many people responded ‘yes, significantly’ or ‘yes, slightly’.

As shown above, for the majority of regions, the higher the median pay, the more financially secure people feel. However, there are a few discrepancies in certain regions, including North West England, Scotland and London.

North West England

Interestingly, North West England is in the bottom half of the average weekly pay with £696 but according to our survey, is the second most financially secure. A reason for this could be that while the average salary in the North West is lower, the cost of living is also lower than other regions. For example, according to ONS, the average house price in the UK as of November 2024 was £333,000. In the North West, it was £253,000.

Scotland

Scotland has one of the highest salaries, falling just behind London, South East England and East of England and also has a lower cost of living than England. It is therefore surprising that Scotland is the third least financially secure according to our survey.

However, in a study completed by the University of Bristol, it was found that 24% of working-age people in Scotland find it a constant struggle to meet financial commitments compared to 20% of those in England.

London

London has the highest average weekly salary out of all the regions across the UK, which is over £70 more than the second highest, South East England. However, it is only the third most financially secure, falling behind South East England and North West England.

The main reason for this discrepancy is that the cost of living in London is much higher than the rest of the UK, meaning that even though the average salary is significantly more, it still isn’t the most financially secure. The average house price in London was £519,579 in October 2024, almost double the national average of £292,059.

Impact of the increased cost of living

No matter where you live in the UK, though, the rising cost of living will likely have had an impact on your daily life. As mentioned earlier, the results of our survey are very clear on this, with over 90% of all respondents agreeing that they’ve been impacted by the rise in living prices.

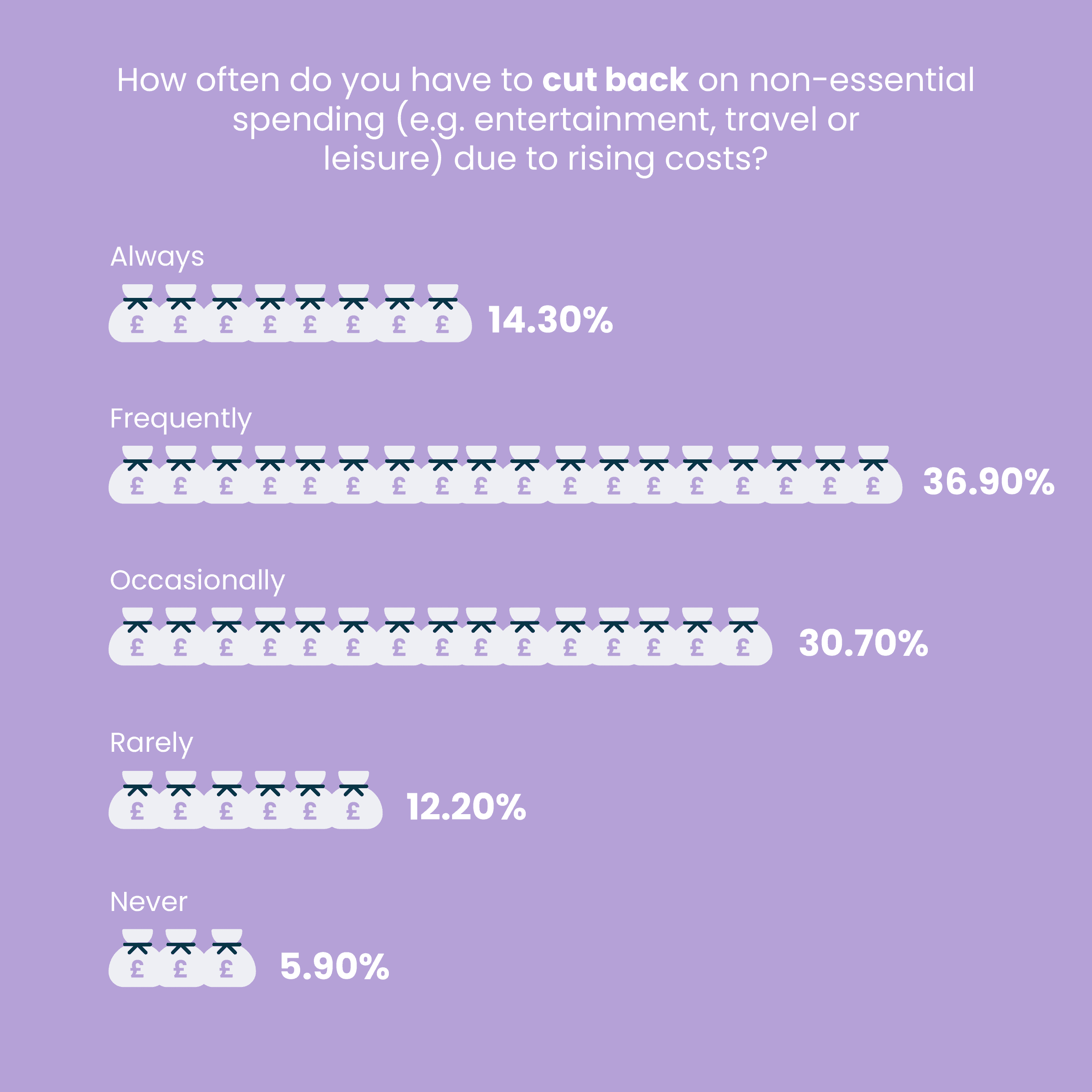

Rising costs can often change your lifestyle as you may need to rework your budget to make ends meet. In our survey, more than 50% of respondents said they always or frequently cut back on non-essential spending, such as entertainment, travel or leisure, due to the increased cost of living.

Food and bills

While it may be easier to reduce non-essential spending, paying your bills and buying food is a different matter. As discussed, food prices have increased significantly over the past 10 years.

It is therefore unsurprising that in our survey, when asked what the biggest challenge they face regarding the cost of living, over 40% of respondents answered ‘increase in bills’ and over 30% said ‘higher food prices’. Similarly, the two most popular answers to what items people spent more on over the past 10 years were ‘bills’ and ‘food’.

Debt

As prices have skyrocketed, many households have found it difficult to keep up with costs, with over 55% of those surveyed saying they have struggled with their finances in the past year. Sadly, nearly 40% said that they had found themselves in debt over the last decade.

Dealing with debt can feel overwhelming, especially with rising costs. However, debt advice and solutions such as Debt Relief Orders (DROs) and Individual Voluntary Agreements (IVAs ) are available to help make debt more manageable.

Mental health

With the ongoing stress of debt and rising food prices and bills, many people’s mental health has taken a hit. Of those we surveyed, over 40% reported that their mental health had suffered due to the crisis. Considering around 1 in 4 adults typically suffer from mental health issues, this statistic is cause for concern.

Looking forward

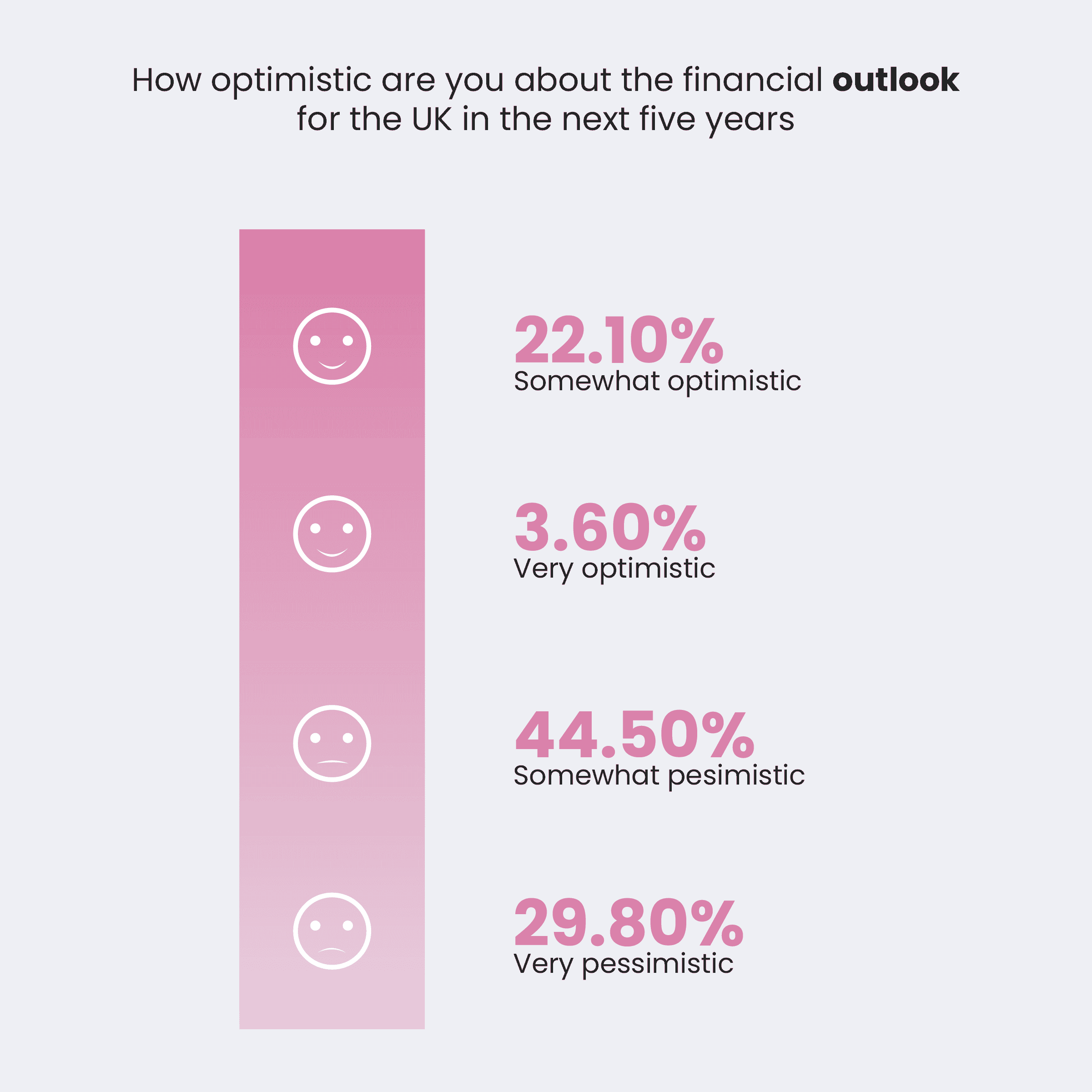

There’s no denying that changes in the cost of living over the past decade have been hard for a lot of people, as outlined in the answers to our survey. However, despite all this, over 25% of those surveyed have a very or somewhat optimistic outlook for the UK’s financial future.

The current crisis will come to an end once prices have stabilised and wages have risen accordingly. Although there’s no definitive answer on when this will be, there’s already been some progress with annual growth in employee’s average wage increasing by 5.2% between August and October 2024.

Our survey also found that nearly 65% of people don’t feel alone in their financial situation. Personal finance is a private matter so it’s easy to feel isolated in your struggles but the current Cost of Living Crisis has led to more open discussions about financial wellbeing. It’s important to know that you’re not facing these struggles alone and there is help and support available. As well as mental health support from charities like Mind, services like MoneyHelper offer free debt advice and assistance.

Tips to help with the current cost of living

Rising costs can make life feel overwhelming. However, there are some small things you can do to help reduce your outgoings and save money:

- Track your spending and set a budget

The first step to saving money is keeping track of what money is coming in and out of your account every month. This helps you to identify your spending habits and where you could potentially cut back costs. For example, if your monthly bill for streaming service subscriptions is higher than you’d like, you can consider cancelling the ones you use least.

Once you have a clear idea on where you’d like to cut back, you can set a budget for the month, ensuring you have enough set aside for essentials such as food and household bills. This will help with managing your money and making sure you’re not overspending on non-essentials.

- Download a budgeting app

To help manage your money that much easier, there are a number of budgeting apps available, such as Snoop and Plum. Snoop allows you to track your spending behaviour by category and alerts you if there’s a better deal available for your household bills. Plum offers ‘Round-ups’, which round up your transactions to the nearest pound and set aside the difference. There is also an automatic saving option where Plum’s algorithm analyses your income and expenses, putting money aside where it can.

- Complete a money saving challenge

If you’re hoping to set money aside, there are a number of challenges you can try to gradually build up your savings. For example, the 1p challenge. On day 1, you save 1p, on day 2, you save 2p and keep building it up until day 365 where you save £3.65. At the end of the year, you’ll have saved £667.95. Alternatively, you could try the £1 challenge where you save £1 every day for a year, so you’ll end up with £365 saved.

- Turn down your thermostat

Due to the rising energy prices, it’s a good idea to keep an eye on how much power you’re using. Your thermostat should be set at the lowest comfortable temperature, which is between 18 and 21 degrees for the majority of people. By turning your thermostat down just one degree, e.g. from 22 to 21 degrees, you can save £90 a year.

- Improve your home’s insulation

Another way you can reduce your heating bills is insulating your home so warm air doesn’t escape so easily. There are some simple ways to do this, such as using rugs and draught excluders to cover any gaps in the floor or under the door, and closing your curtains at night to avoid heat escaping through your window. You can also invest in a hot water cylinder jacket or radiator reflector foil to reduce heat loss and save money in the long run.

- Switch appliances off at the plug

This is a simple one that can save you money. If appliances aren’t turned off at the plug, they can still use electricity even though they’re in standby mode. Turning off at the plug when you’re not using an appliance, such as your TV, can therefore help to reduce your electricity bills.

- Plan your meals in advance

Having a clear plan of what you’re going to eat in the week can help you to spend more efficiently on groceries. It can help avoid food waste and avoid impulse buying takeaways or expensive food when you don’t know what to cook. You can also batch cook and freeze so you have meals ready to go on days when time is tight.

- Get advice on debt solutions

If you’re struggling to make payments and have found yourself in significant debt due to the Cost of Living Crisis, it may be worth looking into debt solutions such as a Debt Management Plan (DMP), which allows you to make small repayments over an extended period of time.

To discover more about how to manage your debt and to receive free debt advice, you can visit www.moneyhelper.org.uk.

While the increase in the cost of living over the past decade has impacted everyone differently depending on where they live and their own personal circumstances, the overarching impact is clear: more people are cutting back on non-essential spending, struggling with debt and feeling the mental health toll of rising expenses.

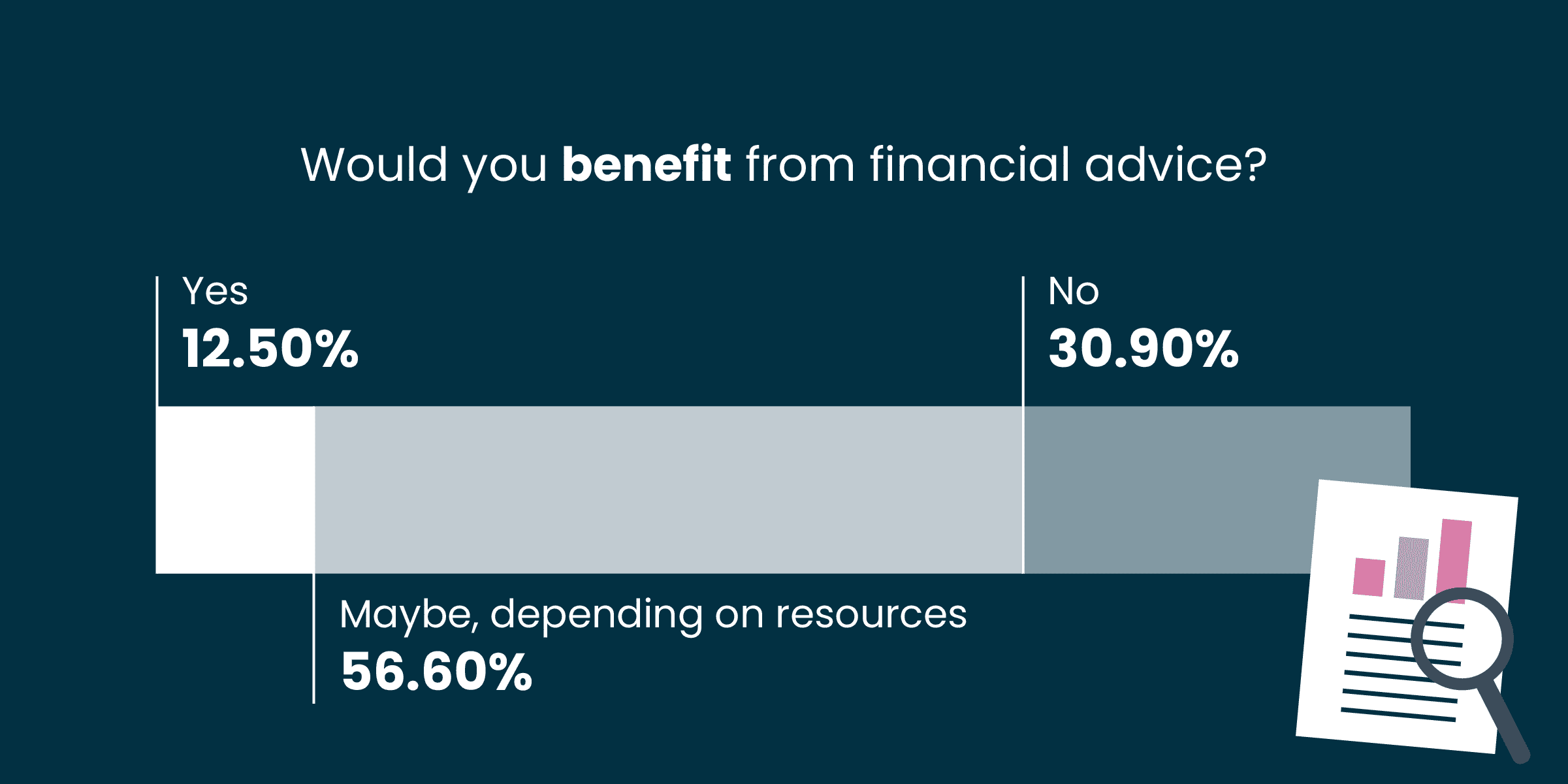

Despite the hardships, however, there are signs of resilience and optimism. As prices stabilise and wages continue to grow, there may be relief on the horizon. In the meantime, it’s essential to access financial advice and support when needed.