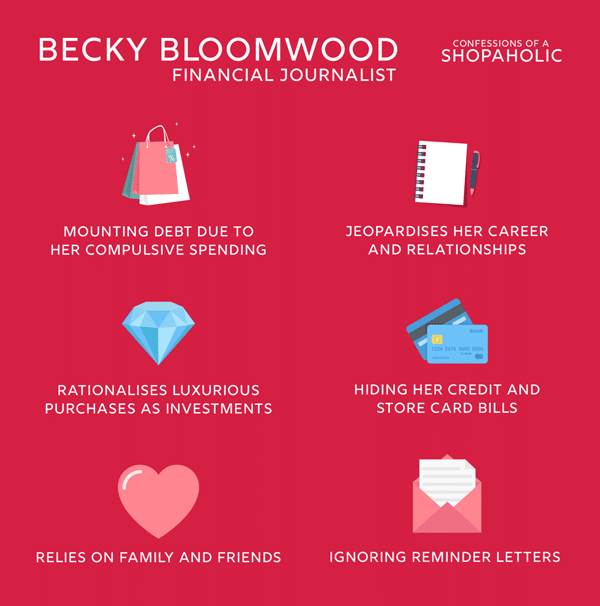

Debt can affect anyone, regardless of income, profession, or lifestyle, which is why it’s important to talk about money troubles and the impact they can have on day-to-day life. To help open up the conversation about debt, we look to some of our favourite popular TV shows and film characters who have struggled with financial difficulties and debt.

From Carrie Bradshaw’s lavish spending beyond her means in Sex and the City to Joey Tribianni’s lack of savings to fall back on and unstable income in Friends, looking at these fictional characters and how they dealt with debt can provide valuable insight into the real-life challenges many people are faced with when it comes to managing their finances.

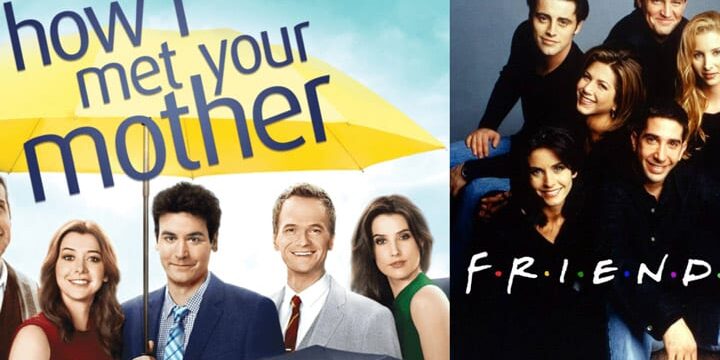

Carrie Bradshaw – Sex and the City

Known for her extravagant spending habits on designer shoes and an impressive wardrobe, Carrie Bradshaw would have certainly been in a precarious financial situation. Not to mention the amount of cosmopolitans and cigarettes she would spend money on.

Throughout the show, the iconic character spent an estimated $40,000 on shoes alone and given her career as a freelance writer, her spending habits didn’t quite match up with what she would have earned on a writer’s salary.

Not only did Carrie have expensive taste in clothes, but she would often take cabs across New York City instead of opting for a more affordable transportation option like the subway, which would have been more cost-effective. In the show, Carrie lives alone in a rented apartment on the Upper East Side of New York City, which would have been expensive for one person to afford, which again seemed unrealistic based on a writer’s salary.

Her spending habits also have an impact on her friendships, and at one point Carrie has to borrow money from her friend, Charlotte, to pay towards her food and rent.

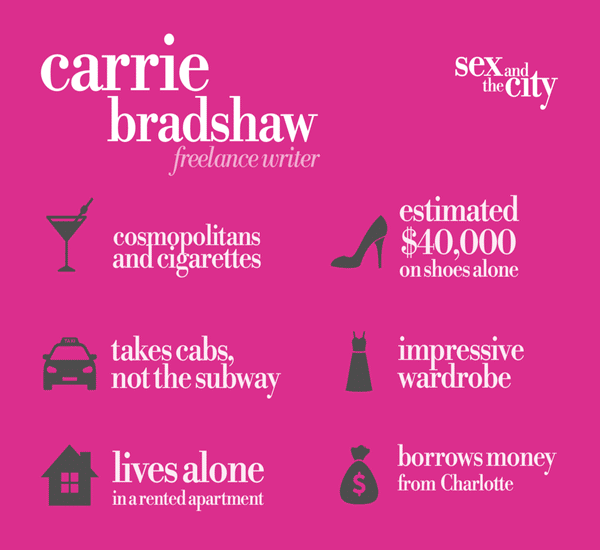

Joey Tribianni – Friends

Joey Tribianni’s struggling acting career in Friends impacted his finances massively throughout the show. Often his roommate, Chandler, would have to cover his share of the apartment bills and help him fund his acting lessons and headshots.

There were times when Joey lived alone at the apartment, which was located in New York City’s Greenwich Village, and this was an unrealistic part of the show for many viewers as Joey would not be able to afford such a lavish apartment in such an expensive neighbourhood.

While the loveable character mostly struggled with his finances throughout the series, there was a time when Joey landed a role on Days of Our Lives, an American soap opera that paid really well. This meant that Joey could move out of his shared apartment and into his own place which he furnished with expensive pieces.

Spending so much money frivolously without any savings or an emergency fund backfired on Joey, and he ended up moving back in with Chandler and continued with bad money habits throughout the rest of the series.

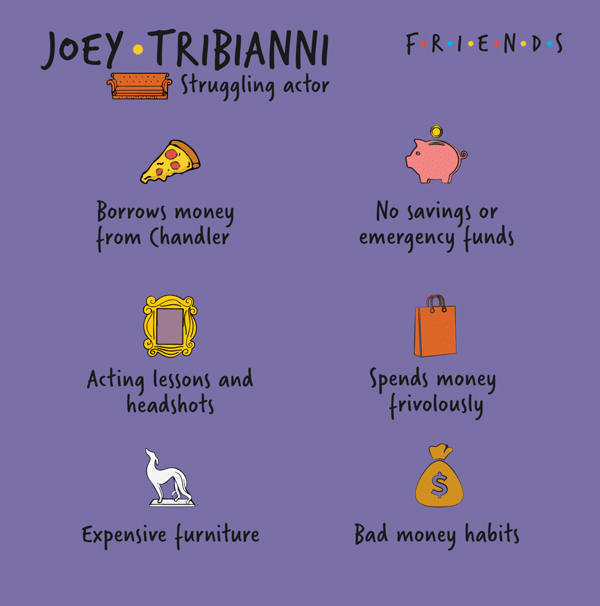

Rebecca “Becky” Bloomwood – Confessions of a Shopaholic

Becky Bloomwood works at Successful Savings magazine as a financial journalist. The irony about this is she has a shopping addiction and has mounting debt due to her compulsive spending. She tries to avoid confronting her money troubles by hiding her credit and store card bills under her bed and even ignoring reminder letters from creditors.

Becky rationalises her luxurious purchases of designer clothes, beauty products and homeware as investments, and convinces herself that she needs them. She often relies on family and friends to help cover her expenses and bail her out of financial difficulties. Unable to manage her finances and shopping addiction accordingly, Becky ends up jeopardising her career and relationships with her family and friends.

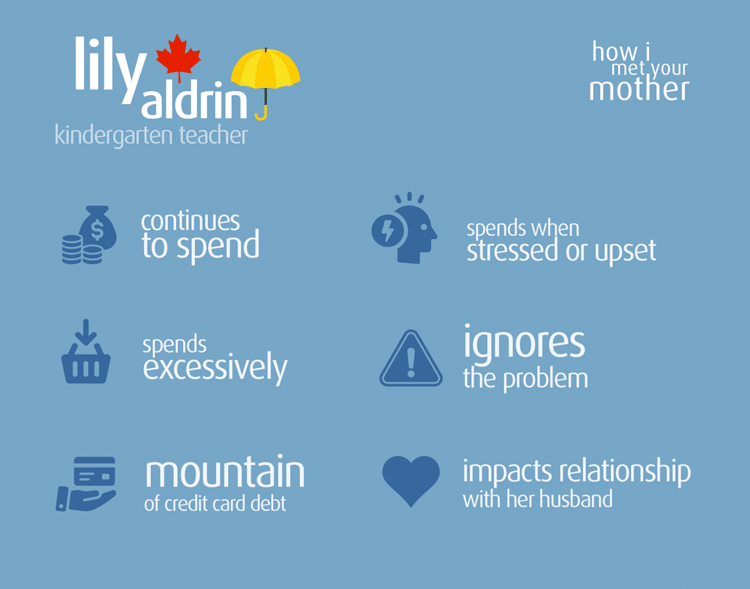

Lily Aldrin – How I Met Your Mother

Lily Aldrin is in a cycle of spending excessively to console herself when she feels stressed or upset, but when she gets her credit card bill and sees the amount she owes, the cycle continues.

It’s revealed in an episode that Lily has accumulated a mountain of credit card debt over the years. Rather than face her money troubles and set herself a reasonable budget, she ignores the growing problem and continues to spend.

This impacts her relationship with her husband, Marshall, when he’s faced with a tough decision of whether to take a high-paying corporate job or his dream role as an environmental lawyer that pays much less. In the end, Marshall takes the higher-paying job which could have had devastating consequences for their relationship.

The debt that Lily acquired is not mentioned again throughout the series, and viewers point out that such an amount of debt would have impacted her life in other ways, such as buying a home which she and Marshall eventually do.

Conclusion

These fictional characters from popular favourite TV shows and films discussed throughout the article are relatable examples of how real people struggle daily with debt due to impulsive spending, unrealistic lifestyles, and a lack of financial planning.

Jonathan Mills, CCO of MoneyPlus Advice shares “Debt is something that affects us all, yet it’s still a topic that carries a certain stigma.

At MoneyPlus, we believe that being open about debt and seeking help early is the best way to tackle financial issues before they become unmanageable, sometimes a simple conversation with a family member, friend or professional can trigger the first steps to alleviating the stress that problem debt brings.

It’s encouraging to see many popular TV and film characters struggle with spending and debt, showing just how common the issue really is. We want to highlight that the issue is much more common than people may think, hopefully shedding some of the negativity and judgement that surrounds the issue”.

Each of these characters spends beyond their means, fails to budget accordingly and relies on family and friends to get them out of these difficult situations.

By acknowledging these common difficulties that people face, viewers can be empowered to take control of their finances and avoid similar situations. Not only do these storylines open up the conversation about debt to allow people to seek financial help, but they also allow people to make informed decisions that help them achieve financial security.

To discover more about how to manage your debt and to receive free debt advice, you can visit www.moneyhelper.org.uk.