Support and guidance

We offer debt advice and support to everyone who gets in touch.

Potentially stop creditor contact

Although not guaranteed, some solutions will stop all contact from creditors.

Reduce interest and charges

We’ll always aim to freeze interest and charges, and we succeed over 95% of the time.

You’re in safe hands.

We’ve helped tens of thousands of people take control of their unsecured debts.

Our most popular debt solutions.

A flexible debt solution

Debt Management Plan

With a Debt Management Plan (DMP), you come to an informal agreement with your creditors to repay the money you owe. Our specialists will help you calculate how much you can afford and then you’ll make one set repayment per month. This money is divided between your creditors. A DMP isn’t insolvency. You aren’t tied in for a minimum period, and if your financial circumstances change, you can alter your repayment plan.

Protect your home from repossession

Individual Voluntary Arrangement

An IVA is a legally binding agreement that you reach with your creditors. Under an Individual Voluntary Arrangement, you pay an affordable monthly sum over a fixed period of time. This is usually 5 or 6 years. Any debt that remains after this point is written off.

On average, MoneyPlus IVA customers write off more than 70% of their total debt. Over a third write off 80% or more.* With an IVA, you’re also protected from creditor contact, legal action, asset repossession and increasing interest and charges.

*From April 2022 to April 2023 our average debt write off for IVA customers was 74% and 36% of customers achieved a debt write off of over 80%.

How it works.

We’re here to make things as easy as possible for you. We know that dealing with your debts can be stressful and confusing, which is why our experts do as much of the work for you as we can. If you qualify, here’s what happens when you contact us:

Talk to our experts.

Chat to our specialists about your finances and the debts you’re struggling with.

Find the right solution for you.

Based on your individual situation, we’ll come up with a plan to get you out of debt. This may be through one of our managed solutions or it may not be. Our advice is based on what’s right for you.

Take the next step.

If you’re using our managed solutions, we’ll reach out to your creditors and tell them you’re with MoneyPlus. If not, we’ll make sure you know who can help.

See how we can help you take back control of your finances

Why Choose MoneyPlus Advice?

14,000

Based on our numbers up to May 11th 2023,

we’re expecting to give debt advice

to over 14,000 people this year!

1 million +

For our most vulnerable customers, we

successfully fought for £1,042,722 of

unmanageable debt to be written off

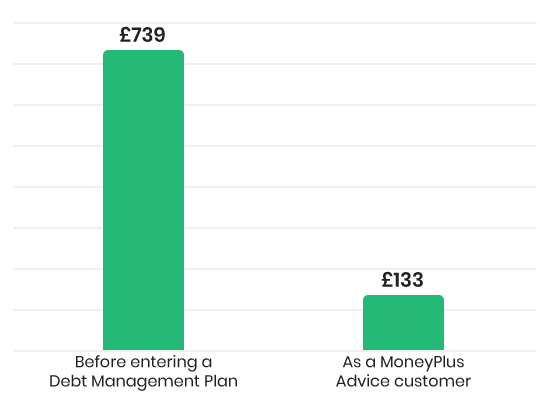

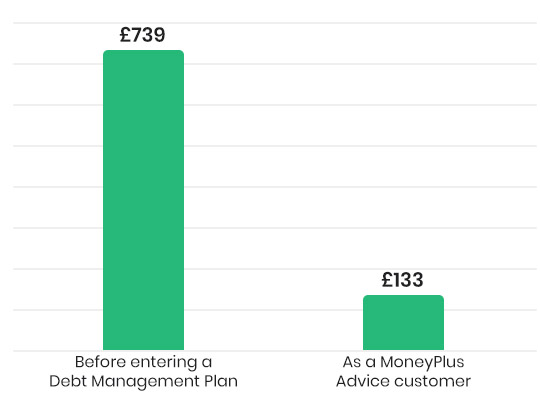

£240

We save our Debt Management Plan

customers on average £240 each

month in interest and charges

Alternatives to a Debt Management Plan or IVA

Protected Trust Deed

Available to eligible people living in Scotland, a Protected Trust Deed is a formal debt solution designed to ease the pressure of debts you can’t afford to repay. It combines these debts into a single monthly payment.

Debt Consolidation Loan

With a Debt Consolidation Loan, you can pay off all of the unsecured debts you have by making one monthly payment, instead of having to pay multiple creditors separately.

Administration Order

An Administration Order is a formal agreement that allows you to repay debts over a specified time period, typically 3 years. It’s available to people with at least 2 debts that total less than £5,000 and who have an unpaid County Court Judgement (CCJ).

Minimal Asset Process (MAP)

This is a scheme intended for people with few or no assets and without the disposable income they need to make debt repayments.

Bankruptcy

Usually seen as a last resort, Bankruptcy is a legal process and a type of insolvency that writes off debts you can’t afford to repay. It may be suitable for you if you can’t repay the money you owe in a reasonable amount of time.

Settlement

A Settlement involves making a lump sum payment to your creditors. This can either be a full and final settlement or a partial settlement.

Remortgage

By Remortgaging, you can renegotiate the terms of your current mortgage and release equity that may have built up in your property. You can use the lump sum this provides to pay off your outstanding debts and potentially to free up income.

Breathing Space

The Debt Respite Scheme, also known as Breathing Space, offers legal protection from action by creditors for up to 60 days. This includes the majority of enforcement actions, including adding interest and charges and making general contact.

“I really cannot speak too highly of MoneyPlus, they literally saved my life.“

— Stuart, Norfolk

Read Stuart’s story…

Still unsure or want to know more?

Confused about which debt solution might be best for you? Don’t worry, help is at hand. At MoneyPlus, we know that everyone’s financial situation is unique. That’s why we approach all our customers with the individuality and care they deserve. We’ll find a solution that works for you.

Simply get in touch with our specialists today to find out more about our trusted debt help solutions. We’re here to help you start living better.

-

What Is Debt Collection?

Debt collection is the process used by creditors to get money back that hasn’t been paid by individuals or businesses who owe it. It’s important for both the people trying to collect the debt and those who owe the money to understand each step of this process. This helps creditors recover their money and makes…

-

Can an IVA Take My Inheritance?

Coming into an inheritance can be a significant financial event in your life. Often unexpected and sometimes more substantial than you may have thought, these windfalls can have the ability to alter your financial outlook and even change your life. However, if you’re in debt and are using a debt management solution, such as an…

-

The Most Indebted TV and Film Characters

Debt can affect anyone, regardless of income, profession, or lifestyle, which is why it’s important to talk about money troubles and the impact they can have on day-to-day life. To help open up the conversation about debt, we look to some of our favourite popular TV shows and film characters who have struggled with financial…